In a world that often seems to be stacked against veterans, the United States of America Armed Forces National Credit Union (USAANFCU) stands as a beacon of support. Understanding the unique challenges faced by those who have served our country, USAANFCU offers a special emergency loan program with an impressive 2% interest cap rate. This article delves into the details of this program and how it can make a significant difference in the lives of veterans.

## The Importance of Financial Assistance for Veterans

For veterans, transitioning back to civilian life can be fraught with difficulties, especially when it comes to financial stability. Many find themselves dealing with unexpected expenses, whether it’s medical bills, home repairs, or educational costs. These emergencies can strain a veteran’s budget, leading to stress and anxiety.

USAANFCU recognizes this critical need and has designed a loan program specifically for veterans. The 2% interest cap rate is not just a financial benefit; it’s a testament to the credit union’s commitment to serving those who have served our nation.

## The 2% Interest CAP Rate: What It Means for Veterans

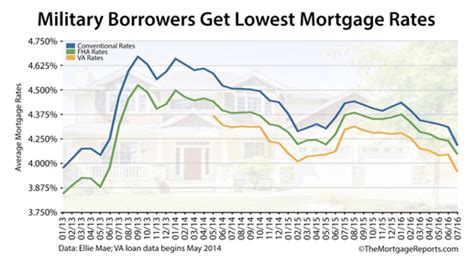

The 2% interest cap rate on emergency loans is significantly lower than the rates offered by many traditional lenders. This means that veterans can borrow the necessary funds without the burden of exorbitant interest payments. The low interest rate makes these loans more accessible and manageable, allowing veterans to focus on addressing their immediate needs.

### Key Benefits of the 2% Interest CAP Rate Loan:

– **Lower Monthly Payments**: With a lower interest rate, monthly payments are reduced, easing the financial strain on veterans.

– **Faster Debt Repayment**: The lower interest rate accelerates the process of repaying the loan, helping veterans get back on their feet sooner.

– **Peace of Mind**: Knowing that the interest rate is capped at 2% provides veterans with a sense of security and financial stability.

## Eligibility Requirements

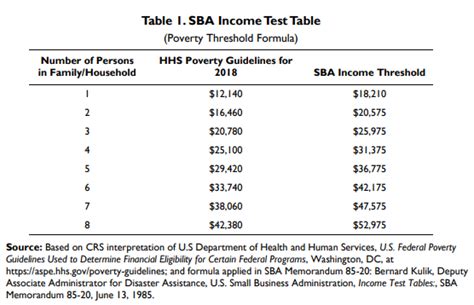

To qualify for a veteran emergency loan at the 2% interest cap rate, applicants must meet the following criteria:

– **Membership in USAANFCU**: All applicants must be members of the credit union, which is open to military personnel, veterans, and their families.

– **Satisfactory Credit History**: While the interest rate is low, a good credit history still plays a role in the approval process.

– **Proof of Service**: Applicants must provide documentation of their military service to demonstrate eligibility.

## Applying for a Loan

Applying for a veteran emergency loan through USAANFCU is a straightforward process. Veterans can visit the credit union’s website or visit a branch location to begin the application. The online application is user-friendly and requires basic information about the applicant’s financial situation and the purpose of the loan.

Once the application is submitted, the credit union reviews it and may require additional documentation. The approval process is quick, and if approved, veterans can receive their funds within a few days.

## Conclusion

USAANFCU’s 2% interest cap rate emergency loan program is a shining example of how financial institutions can support the community they serve. For veterans dealing with financial emergencies, this program offers a lifeline with manageable payments and a clear path to recovery. By taking advantage of this unique opportunity, veterans can focus on rebuilding their lives and continuing to serve their communities in new ways.