Introduction:

When it comes to auto insurance, understanding the intricacies of coverage can be a daunting task. One such aspect is GAP (Guaranteed Auto Protection) insurance, which helps bridge the gap between what you owe on your vehicle and its actual cash value in the event of a total loss. This article delves into the math behind GAP insurance, comparing 150% loan-to-value (LTV) vs. actual cash value (ACV) payouts.

Understanding GAP Insurance:

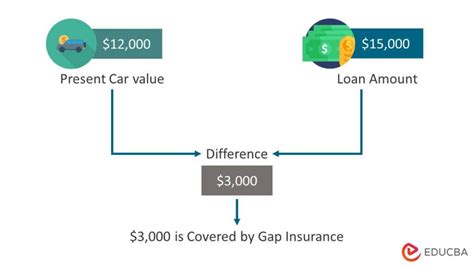

GAP insurance is an optional add-on to your auto insurance policy that protects you from the financial shortfall that occurs when your car is totaled or stolen and the insurance payout is less than what you owe on the vehicle. It’s important to note that GAP insurance does not cover damage to your vehicle due to accidents, natural disasters, or theft.

150% Loan-to-Value vs. Actual Cash Value Payouts:

1. 150% Loan-to-Value (LTV) Payouts:

When you opt for a 150% LTV GAP insurance policy, your insurance provider will cover the difference between your car’s actual cash value and the total amount you owe on your loan, up to 150% of the vehicle’s original value. This means that if your car is worth $20,000 and you owe $30,000, the insurance company will pay off the entire $30,000, minus any deductible you may have.

Advantages:

– Full coverage in the event of a total loss

– No financial burden for the borrower

– Quick and straightforward process

Disadvantages:

– Higher premiums compared to ACV policies

– May not be available for all vehicles

2. Actual Cash Value (ACV) Payouts:

An ACV GAP insurance policy covers the difference between your car’s actual cash value and the total amount you owe on your loan, up to the car’s original value. In the previous example, if your car is worth $20,000 and you owe $30,000, the insurance company will pay off the $10,000 difference, minus any deductible.

Advantages:

– Lower premiums compared to 150% LTV policies

– May be more affordable for some borrowers

Disadvantages:

– Limited coverage in the event of a total loss

– May result in a financial burden for the borrower

Conclusion:

When choosing between a 150% LTV and an ACV GAP insurance policy, it’s important to consider your financial situation and the value of your vehicle. While 150% LTV policies offer full coverage and peace of mind, they come with higher premiums. On the other hand, ACV policies are more affordable but provide limited coverage. Ultimately, the best choice depends on your individual needs and preferences. Be sure to compare quotes from different insurance providers and read the fine print before making a decision.