Introduction:

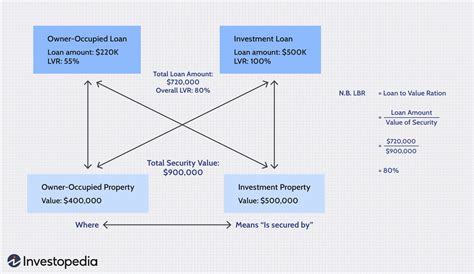

In the realm of real estate finance, cross-collateralization clauses have become a prevalent feature in multi-property mortgage agreements. These clauses allow lenders to secure multiple properties with a single mortgage, offering convenience and flexibility to borrowers. However, this arrangement also introduces certain risks that borrowers and lenders alike need to be aware of. This article aims to explore the potential risks associated with cross-collateralization clauses in multi-property mortgages.

1. Increased Risk of Default:

One of the primary risks of cross-collateralization clauses is the increased likelihood of default. When a borrower uses a single mortgage to secure multiple properties, the failure of one property’s performance can have a cascading effect on the others. For instance, if a borrower faces financial difficulties and is unable to meet the mortgage obligations on one property, the lender may take action against all properties involved, leading to potential defaults on the remaining properties.

2. Loss of Flexibility:

Cross-collateralization clauses can limit a borrower’s flexibility in managing their properties. Since the lender holds a lien on multiple properties, any decision to sell, rent, or refinance one property may require the lender’s consent. This can complicate the borrower’s ability to make strategic decisions regarding their property portfolio and potentially delay or hinder their financial objectives.

3. Enhanced Liability:

In the event of default, cross-collateralization clauses can result in a higher liability for the borrower. When multiple properties are secured by a single mortgage, the total debt amount may be larger than if each property had its own mortgage. This can leave the borrower with a higher outstanding balance and potentially increase the chances of foreclosure or repossession.

4. Market Fluctuations:

Real estate markets are subject to fluctuations, and these can impact the value of properties. With cross-collateralization clauses, the decline in value of one property can have a direct impact on the others. If the value of one property decreases significantly, it may reduce the overall equity position of the borrower, potentially leading to financial strain and a higher risk of default.

5. Legal and Compliance Issues:

Cross-collateralization clauses can raise legal and compliance concerns. Lenders and borrowers must ensure that the terms of the agreement comply with applicable laws and regulations. Failure to do so may result in legal disputes, fines, or even the invalidation of the mortgage agreement.

Conclusion:

While cross-collateralization clauses in multi-property mortgages offer certain advantages, such as convenience and flexibility, they also come with significant risks. Borrowers and lenders should carefully consider the potential drawbacks associated with these clauses and take appropriate measures to mitigate the risks. It is advisable to seek legal and financial advice to ensure that the mortgage agreement is structured in a way that aligns with the borrower’s long-term objectives and protects their interests.