Introduction:

Auto loans have become an integral part of the modern consumer’s financial landscape. As car prices continue to rise, many individuals turn to auto loans to finance their purchases. However, understanding the intricacies of auto loan amortization can be challenging. One such aspect is the front-loaded interest payment, which can significantly impact the total cost of the loan. In this article, we will delve into auto loan amortization tricks and analyze the effects of front-loaded interest payments.

Understanding Auto Loan Amortization:

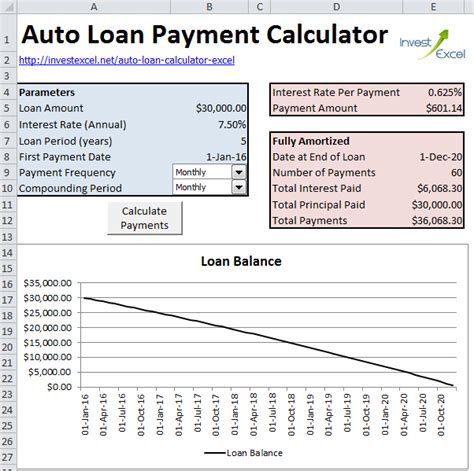

Auto loan amortization refers to the process of paying off a loan through regular installments over a set period. Each payment typically consists of two components: principal and interest. The principal is the amount borrowed, while the interest is the cost of borrowing the money.

In the early stages of an auto loan, a larger portion of the payment goes towards interest, and a smaller portion goes towards the principal. As the loan progresses, the ratio of principal to interest changes, with a higher proportion of the payment going towards the principal.

Front-Loaded Interest Payments:

A front-loaded interest payment is a situation where the interest portion of the loan is higher in the initial years of the loan term. This means that a larger portion of the payment is allocated to interest, and a smaller portion goes towards reducing the principal balance.

The following factors contribute to front-loaded interest payments:

1. Longer loan terms: Longer loan terms typically result in higher interest rates and front-loaded payments.

2. Larger loan amounts: Larger loan amounts can lead to higher interest payments, as the interest rate is applied to a higher principal balance.

3. Higher interest rates: Higher interest rates directly increase the amount of interest paid in each payment, leading to front-loading.

The Impact of Front-Loaded Interest Payments:

Front-loaded interest payments can have several implications for borrowers:

1. Higher initial payments: Borrowers may find that their initial monthly payments are higher due to the front-loaded interest component.

2. Slower principal reduction: Since a larger portion of the payment goes towards interest, the principal balance is reduced more slowly, extending the loan term.

3. Total cost of the loan: The front-loaded interest payments can lead to a higher total cost of the loan, as the borrower pays more in interest over the loan’s lifetime.

Auto Loan Amortization Tricks:

To mitigate the impact of front-loaded interest payments, borrowers can employ the following amortization tricks:

1. Refinance: Borrowers can refinance their auto loans to obtain a lower interest rate, reducing the front-loaded interest payments and shortening the loan term.

2. Bi-weekly payments: By making bi-weekly payments instead of monthly payments, borrowers can reduce the total interest paid over the loan’s lifetime.

3. Extra payments: Making extra payments towards the principal can help reduce the loan balance faster, thereby reducing the total interest paid and the loan term.

Conclusion:

Understanding auto loan amortization, particularly the front-loaded interest payment, is crucial for borrowers to make informed financial decisions. By analyzing the impact of front-loaded interest payments and employing amortization tricks, borrowers can minimize the total cost of their auto loans and achieve financial freedom more quickly.