Introduction:

Understanding the statute of limitations for private loans is crucial for both borrowers and lenders. The statute of limitations is a legal time limit within which a creditor can file a lawsuit to collect a debt. Once this period expires, the debt becomes unenforceable, and the creditor cannot legally pursue the debt through legal means. This article provides a comprehensive overview of the private loan statute of limitations by state, with expiry charts to help you stay informed.

I. Overview of Private Loan Statute of Limitations

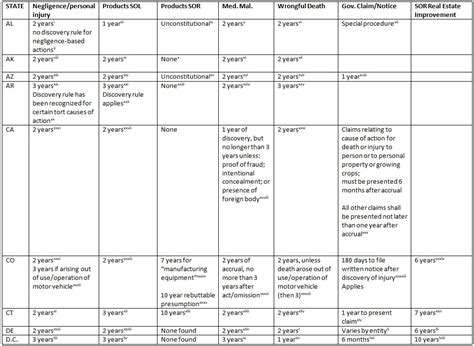

The statute of limitations for private loans varies by state. Generally, it ranges from three to six years. However, some states have different limitations for written and oral contracts, and for open accounts. Below is a breakdown of the general statute of limitations for private loans in the United States.

II. Private Loan Statute of Limitations State-by-State Expiry Charts

The following charts provide an overview of the private loan statute of limitations by state. Please note that these charts are for informational purposes only and may not reflect the most current changes in state laws.

A. Written Contracts

| State | Statute of Limitations |

|——————-|————————|

| Alabama | 6 years |

| Alaska | 6 years |

| Arizona | 6 years |

| Arkansas | 6 years |

| California | 4 years |

| Colorado | 6 years |

| Connecticut | 3 years |

| Delaware | 6 years |

| District of Columbia | 3 years |

| Florida | 5 years |

| Georgia | 6 years |

| Hawaii | 6 years |

| Idaho | 6 years |

| Illinois | 5 years |

| Indiana | 6 years |

| Iowa | 6 years |

| Kansas | 6 years |

| Kentucky | 6 years |

| Louisiana | 5 years |

| Maine | 6 years |

| Maryland | 3 years |

| Massachusetts | 6 years |

| Michigan | 6 years |

| Minnesota | 6 years |

| Mississippi | 6 years |

| Missouri | 5 years |

| Montana | 6 years |

| Nebraska | 6 years |

| Nevada | 6 years |

| New Hampshire | 3 years |

| New Jersey | 6 years |

| New Mexico | 6 years |

| New York | 6 years |

| North Carolina | 3 years |

| North Dakota | 6 years |

| Ohio | 6 years |

| Oklahoma | 6 years |

| Oregon | 6 years |

| Pennsylvania | 6 years |

| Rhode Island | 6 years |

| South Carolina | 3 years |

| South Dakota | 6 years |

| Tennessee | 6 years |

| Texas | 4 years |

| Utah | 6 years |

| Vermont | 5 years |

| Virginia | 6 years |

| Washington | 6 years |

| West Virginia | 6 years |

| Wisconsin | 6 years |

| Wyoming | 6 years |

B. Oral Contracts

| State | Statute of Limitations |

|——————-|————————|

| Alabama | 2 years |

| Alaska | 2 years |

| Arizona | 2 years |

| Arkansas | 2 years |

| California | 2 years |

| Colorado | 2 years |

| Connecticut | 2 years |

| Delaware | 2 years |

| District of Columbia | 2 years |

| Florida | 2 years |

| Georgia | 2 years |

| Hawaii | 2 years |

| Idaho | 2 years |

| Illinois | 2 years |

| Indiana | 2 years |

| Iowa | 2 years |

| Kansas | 2 years |

| Kentucky | 2 years |

| Louisiana | 2 years |

| Maine | 2 years |

| Maryland | 2 years |

| Massachusetts | 2 years |

| Michigan | 2 years |

| Minnesota | 2 years |

| Mississippi | 2 years |

| Missouri | 2 years |

| Montana | 2 years |

| Nebraska | 2 years |

| Nevada | 2 years |

| New Hampshire | 2 years |

| New Jersey | 2 years |

| New Mexico | 2 years |

| New York | 2 years |

| North Carolina | 2 years |

| North Dakota | 2 years |

| Ohio | 2 years |

| Oklahoma | 2 years |

| Oregon | 2 years |

| Pennsylvania | 2 years |

| Rhode Island | 2 years |

| South Carolina | 2 years |

| South Dakota | 2 years |

| Tennessee | 2 years |

| Texas | 2 years |

| Utah | 2 years |

| Vermont | 2 years |

| Virginia | 2 years |

| Washington | 2 years |

| West Virginia | 2 years |

| Wisconsin | 2 years |

| Wyoming | 2 years |

III. Conclusion

Understanding the statute of limitations for private loans by state is essential for borrowers and lenders alike. By referring to the expiry charts provided in this article, you can stay informed about the legal time limits for pursuing or defending against private loan debts. Always consult with a legal professional for specific advice regarding your situation.