Introduction:

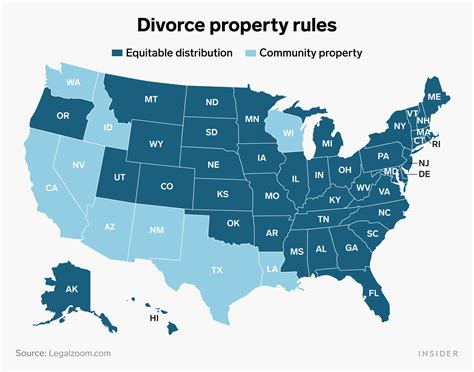

Divorce is an emotionally charged process that often involves the division of assets and debts. One significant financial consideration in divorce is student loans. The distinction between community property and separate debt states can have a profound impact on how student loans are handled during the divorce process. This article aims to provide an overview of community property and separate debt states, and how they affect the division of student loans in divorce.

Community Property States:

In community property states, all assets and debts acquired during the marriage are considered community property, meaning they belong equally to both spouses. This includes student loans taken out during the marriage. In the event of a divorce, community property must be divided equally between the parties, which can create a significant financial burden on one or both ex-spouses.

1. Community Property Division:

When dividing community property, the court considers several factors, such as the length of the marriage, the contribution of each spouse to the acquisition of the asset, and the financial needs of each party. Student loans may be divided equally, or the court may order one spouse to pay a larger portion of the debt based on their ability to pay.

2. Impact on Credit Scores:

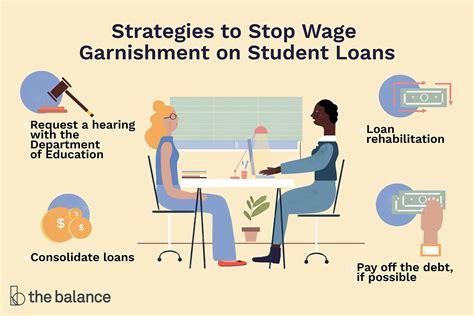

Dividing community property student loans can have a negative impact on the credit scores of both ex-spouses. If one spouse is unable to meet their portion of the debt payments, it can lead to late payments, which can further damage credit scores.

Separate Debt States:

In separate debt states, assets and debts acquired before marriage are considered separate property. However, student loans taken out during the marriage may still be considered separate property if they were not used for the benefit of both spouses.

1. Separate Property Division:

In separate debt states, student loans are generally not subject to division during divorce. If one spouse incurred the debt before marriage, it remains their responsibility. However, if the student loans were taken out during the marriage for the benefit of both parties, the court may order a portion of the debt to be paid by the other spouse.

2. Impact on Credit Scores:

Separate debt states can help protect the credit scores of ex-spouses by preventing the division of student loans. However, if the court orders one spouse to pay a portion of the debt, they may still be affected by late payments and credit score damage.

Conclusion:

The division of student loans in divorce depends on whether the state recognizes community property or separate debt. In community property states, student loans acquired during the marriage are generally divided equally, while in separate debt states, they remain the responsibility of the spouse who incurred the debt. Understanding the differences between these states can help individuals navigate the complexities of divorce and student loans, ensuring that their financial well-being is protected.