Introduction:

In today’s fast-paced financial landscape, emergency cash needs can arise at any moment. Whether it’s an unexpected medical bill, car repair, or home repair, having quick access to cash can make a significant difference. However, the cost of obtaining emergency cash varies significantly between traditional credit unions and fintech lenders. This article delves into the ongoing war of interest rates, pitting 8% APR credit unions against 29.9% fintechs, to help you understand the implications for your financial well-being.

Section 1: Understanding APR

Before diving into the comparison, it’s crucial to understand what Annual Percentage Rate (APR) is. APR is the cost of borrowing money, expressed as a percentage, over the course of one year. It includes interest and any other fees associated with the loan. By comparing APRs, you can determine which option is more cost-effective for your emergency cash needs.

Section 2: Credit Unions: The 8% Option

Credit unions are member-owned financial institutions that prioritize the needs of their members over profit. As a result, they often offer lower interest rates on loans, including emergency cash. With an 8% APR, credit unions provide a competitive option for those in need of quick cash. Here are some key points to consider about credit unions:

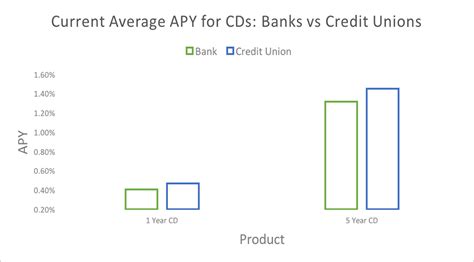

1. Lower interest rates: Credit unions typically offer lower interest rates compared to traditional banks and fintech lenders.

2. Community focus: Credit unions prioritize the well-being of their members, often providing financial education and resources.

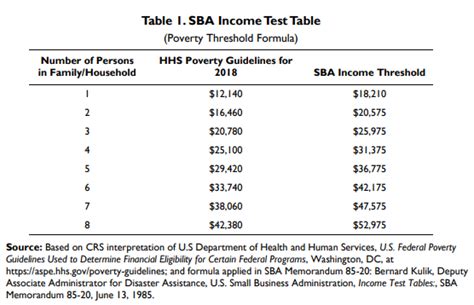

3. Membership requirements: To join a credit union, you must meet specific criteria, such as living in a certain area or working for a particular employer.

Section 3: Fintechs: The 29.9% Option

Fintech lenders, on the other hand, are financial technology companies that use innovative technology to provide financial services. While they may offer convenience and quick access to cash, their interest rates are often much higher than those of credit unions. Here are some factors to consider when it comes to fintech lenders:

1. Higher interest rates: Fintech lenders typically charge higher interest rates, such as 29.9% APR, making them more expensive in the long run.

2. Convenience: Fintech lenders often provide a seamless borrowing experience, allowing borrowers to apply for loans online and receive funds quickly.

3. Limited regulation: Fintech lenders may be subject to less regulation than traditional financial institutions, which could pose risks to borrowers.

Section 4: The Battle of Interest Rates

When comparing the 8% APR credit unions to the 29.9% fintechs, it’s clear that credit unions offer a more cost-effective option for emergency cash needs. However, the convenience and speed of fintech lenders may make them appealing in certain situations. To make an informed decision, consider the following:

1. Your financial situation: If you have a solid credit history and can qualify for a lower interest rate from a credit union, it’s likely the better option.

2. Time sensitivity: If you need cash quickly and are willing to pay a higher interest rate, a fintech lender might be more suitable.

3. Long-term financial goals: If you’re concerned about the long-term impact of high-interest rates, a credit union may be the safer choice.

Conclusion:

The war between 8% APR credit unions and 29.9% fintechs highlights the importance of understanding your financial options when it comes to emergency cash needs. While credit unions offer lower interest rates and a community focus, fintech lenders provide convenience and speed. By considering your financial situation, time sensitivity, and long-term goals, you can make an informed decision to ensure you’re getting the best deal on emergency cash.