Introduction:

Debt management plans have become an essential tool for individuals and organizations struggling with financial challenges. Nonprofits, in particular, rely on these plans to manage their debt and secure a sustainable future. This article aims to explore the success rates of debt management plans, comparing the outcomes of 5-year and 7-year programs within the nonprofit sector.

Section 1: Understanding Debt Management Plans

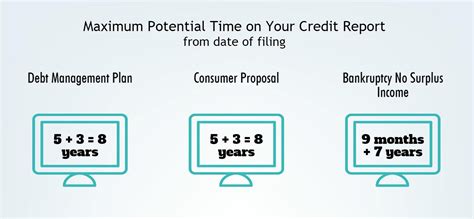

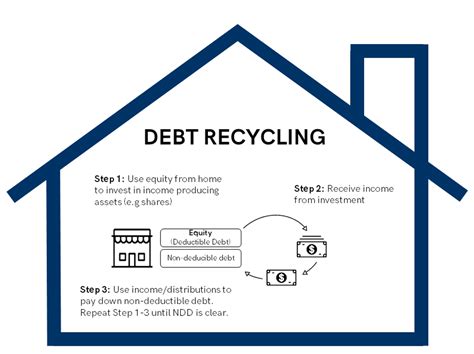

Debt management plans are structured arrangements that help individuals and organizations manage their debt effectively. These plans typically involve consolidating multiple debts into one payment, reducing interest rates, and extending the repayment period. By doing so, debt management plans help clients regain financial stability and reduce the burden of debt.

Section 2: Importance of Debt Management Plans in the Nonprofit Sector

Nonprofits face unique challenges when it comes to managing debt. With limited funding sources and the pressure to allocate resources efficiently, these organizations often struggle to maintain financial health. Debt management plans can provide much-needed relief, enabling nonprofits to focus on their core missions and better serve their communities.

Section 3: Success Rates of 5-Year Debt Management Plans

Research indicates that 5-year debt management plans have a moderate success rate within the nonprofit sector. These programs generally help organizations reduce their debt burden and achieve financial stability. However, the success rate can vary depending on factors such as the initial debt amount, the organization’s financial health, and the effectiveness of the plan.

Section 4: Success Rates of 7-Year Debt Management Plans

7-year debt management plans are designed to provide a more extended period for organizations to manage their debt. While these programs may have longer repayment terms, they also tend to offer lower interest rates and more flexible payment options. As a result, 7-year plans often yield higher success rates compared to their 5-year counterparts.

Section 5: Factors Influencing Success Rates

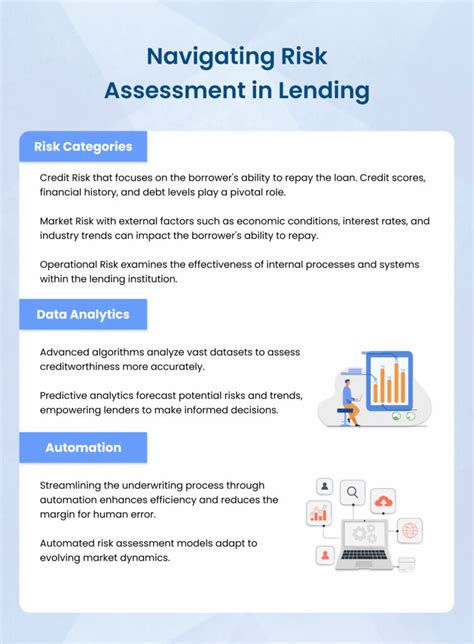

Several factors can influence the success rates of debt management plans in the nonprofit sector:

– The initial debt amount: Organizations with higher debt burdens may require longer repayment periods to achieve financial stability.

– Financial health: Nonprofits with solid financial management practices and strong revenue streams are more likely to succeed in debt management plans.

– Program structure: Effective debt management plans should be tailored to the specific needs of each organization, taking into account its unique financial situation.

– Staff and board involvement: Active participation from the organization’s staff and board members is crucial for the successful implementation of debt management plans.

Conclusion:

In conclusion, both 5-year and 7-year debt management plans can be effective tools for managing debt within the nonprofit sector. While 7-year plans tend to have higher success rates, the ultimate success of a debt management plan depends on various factors, including the organization’s financial health and the effectiveness of the program itself. By carefully evaluating these factors, nonprofits can make informed decisions regarding the best approach to managing their debt and securing a sustainable future.