Introduction:

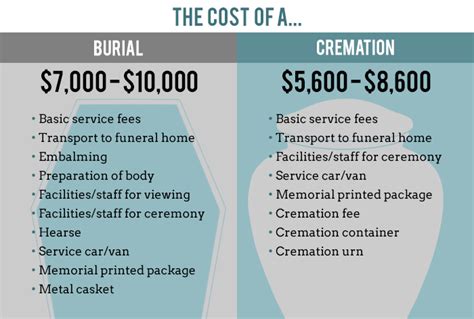

Losing a loved one is an emotionally challenging time, and the financial burden of arranging a funeral can add to the stress. To ease this burden, many families turn to funeral cost financing options. One common choice is a burial loan, which can be structured with different repayment terms. In this article, we will explore the differences between a 12-month and a 24-month burial loan term, helping you make an informed decision for your financial needs.

12-Month Burial Loan Terms:

1. Shorter Repayment Period:

A 12-month burial loan term means that the entire loan amount, including interest, must be repaid within one year. This can be advantageous for those who prefer a shorter commitment and want to clear the debt quickly.

2. Higher Monthly Payments:

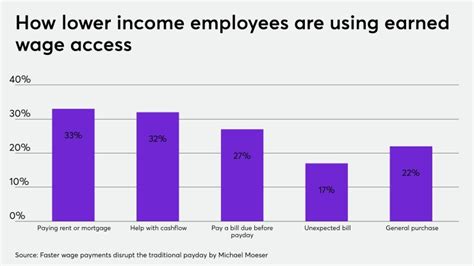

To repay the loan within a year, monthly payments will be higher compared to a longer-term loan. This can be a concern for some borrowers, especially if they have limited income or other financial obligations.

3. Potential for Lower Interest Rates:

Since the loan is repaid within a shorter period, lenders may offer lower interest rates on 12-month burial loans. This can result in a lower overall cost of borrowing.

4. Quick Access to Funds:

A 12-month burial loan can provide quick access to funds, allowing you to arrange the funeral promptly. This can be particularly beneficial if there is an urgency to cover the expenses.

24-Month Burial Loan Terms:

1. Longer Repayment Period:

A 24-month burial loan term extends the repayment period to two years. This can be helpful for those who need more time to manage their finances and repay the loan.

2. Lower Monthly Payments:

With a longer repayment period, monthly payments will be lower compared to a 12-month loan. This can make the loan more manageable for borrowers with a limited income or other financial commitments.

3. Potential for Higher Interest Rates:

Since the loan is repaid over a longer period, lenders may charge higher interest rates on 24-month burial loans. This can result in a higher overall cost of borrowing.

4. Extended Access to Funds:

A 24-month burial loan provides a longer period to arrange the funeral and manage the associated expenses. This can be beneficial for those who need additional time to plan and gather the necessary funds.

Conclusion:

Choosing between a 12-month and a 24-month burial loan term depends on your individual financial situation and preferences. If you prefer a shorter commitment and can afford higher monthly payments, a 12-month loan may be suitable. However, if you need more time to manage your finances and prefer lower monthly payments, a 24-month loan may be a better option. It is crucial to carefully consider your financial capabilities and consult with a financial advisor to make an informed decision that aligns with your needs. Remember, the goal is to ease the financial burden during an already difficult time, so choose a repayment term that suits your unique circumstances.