In today’s dynamic financial landscape, debt recycling strategies have emerged as a powerful tool for homeowners looking to unlock the potential of their home equity. This innovative approach allows individuals to convert the value of their homes into investment capital, enabling them to pursue various financial goals. This article delves into the world of debt recycling strategies, exploring how homeowners can transform their home equity into a catalyst for growth and prosperity.

**Understanding Debt Recycling**

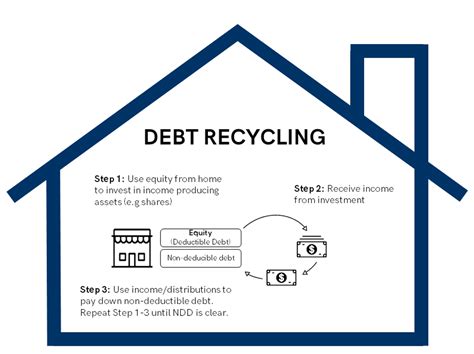

Debt recycling refers to the process of refinancing or restructuring existing debt to free up cash for investment purposes. This practice is often employed by investors to take advantage of favorable interest rates, improve debt ratios, or diversify their investment portfolios. When applied to home equity, debt recycling can unlock significant value, providing homeowners with a valuable resource for investment opportunities.

**How to Turn Home Equity into Investment Capital**

1. Assess Your Home Equity

Before embarking on a debt recycling strategy, it’s essential to evaluate your home equity. This involves calculating the difference between your home’s current market value and the remaining mortgage balance. If your home’s value has appreciated significantly, you may have a substantial amount of equity to tap into.

2. Refinance Your Mortgage

Refinancing your mortgage can be a crucial step in the debt recycling process. By obtaining a new mortgage with a lower interest rate, you can reduce your monthly payments and free up cash. This cash can then be used to invest in various avenues, such as real estate, stocks, or bonds.

3. Tap into Home Equity Lines of Credit (HELOCs)

A HELOC is another popular method for accessing home equity. This revolving line of credit allows you to borrow against your home’s equity, providing you with a flexible source of funding. HELOCs can be an excellent option for short-term investment opportunities or for consolidating high-interest debt.

4. Consider a Cash-Out Refinance

A cash-out refinance involves refinancing your mortgage for an amount greater than your current balance, with the difference paid to you in cash. This strategy can provide a substantial influx of capital, allowing you to invest in various ventures, including real estate investments, business ventures, or educational pursuits.

5. Implement Diversified Investment Strategies

Once you’ve accessed your home equity, it’s crucial to implement a diversified investment strategy. This approach involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities. Diversification can help mitigate risk and maximize returns, ensuring that your investment capital grows over time.

6. Monitor and Adjust Your Portfolio

As with any investment, it’s essential to monitor your portfolio regularly and make adjustments as needed. Keep an eye on market trends, economic indicators, and your personal financial goals. By staying informed and adaptable, you can ensure that your investment capital continues to grow and fulfill your financial objectives.

**Conclusion**

Debt recycling strategies offer homeowners a unique opportunity to turn their home equity into investment capital. By refinancing mortgages, tapping into HELOCs, and implementing diversified investment strategies, homeowners can unlock the full potential of their homes and pursue various financial goals. However, it’s crucial to approach debt recycling with caution, ensuring that you maintain a healthy debt-to-equity ratio and remain financially stable. With the right strategy and mindset, debt recycling can be a powerful tool for unlocking wealth and achieving long-term financial success.