Title: Student Loan Wage Garnishment: Navigating the 15% Disposable Income Hardship Claims

Introduction:

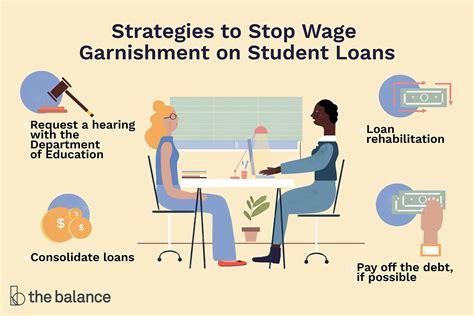

Student loan debt has become a significant burden for many graduates, impacting their financial stability and overall well-being. One of the most distressing aspects of student loan debt is wage garnishment, where a portion of an individual’s earnings is deducted to pay off the debt. This article delves into the concept of wage garnishment, particularly focusing on the 15% disposable income hardship claim, to help borrowers understand their rights and options.

Understanding Wage Garnishment:

Wage garnishment is a legal process where a portion of an individual’s earnings is withheld by their employer and forwarded to creditors to satisfy a debt. It is typically used as a last resort when other payment methods, such as voluntary repayments or consolidation, have failed.

The 15% Disposable Income Hardship Claim:

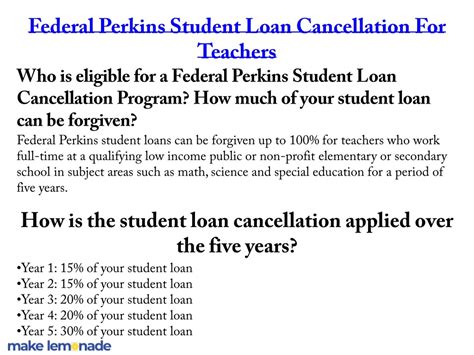

Under the federal Student Loan Rehabilitation program, borrowers have the option to file a hardship claim if they can prove that the 15% of their disposable income after necessary living expenses is not sufficient to meet their student loan payments. If the claim is approved, the borrower may be granted a temporary or permanent modification of their loan terms, reducing their monthly payments and alleviating financial stress.

Determining Disposable Income:

To calculate disposable income, the borrower must first determine their adjusted gross income (AGI), which is their total income before deductions. From this amount, necessary living expenses, such as rent, utilities, food, healthcare, and child support, are subtracted to arrive at the disposable income.

Eligibility for the 15% Hardship Claim:

Not all borrowers are eligible for the 15% hardship claim. The following criteria must be met:

1. The borrower must be in default on their student loan.

2. The borrower must have been in default for less than seven years.

3. The borrower must have a total outstanding debt of less than $130,000, excluding any loans from their spouse.

4. The borrower must have completed a financial assessment, proving that the 15% of their disposable income is not enough to make the monthly payments.

Navigating the Hardship Claim Process:

Filing a hardship claim can be a complex and time-consuming process. Here are some steps to help borrowers navigate the process:

1. Contact your loan servicer to discuss your situation and explore available options.

2. Gather all necessary financial documentation, including income, expenses, and other relevant information.

3. Complete the financial assessment form and submit it to your loan servicer.

4. Be prepared to provide additional documentation if requested by your loan servicer.

5. Follow up with your loan servicer regularly to ensure that your hardship claim is being processed promptly.

Conclusion:

Student loan wage garnishment can be a daunting and stressful experience. However, understanding the 15% disposable income hardship claim and navigating the process can provide borrowers with an opportunity to alleviate financial strain. By exploring all available options and seeking assistance from your loan servicer, you can work towards a more stable and manageable financial future.