Introduction:

Cosmetic surgery is a significant investment, and financing options can greatly impact the patient’s financial journey. With the rise of promotional financing offers and medical credit cards, it’s crucial for individuals to understand the differences and potential traps associated with these options. In this article, we will delve into the 0% promotional Annual Percentage Rate (APR) for cosmetic surgery financing and compare it with the potential pitfalls of medical credit cards.

1. Understanding 0% Promotional APR for Cosmetic Surgery Financing

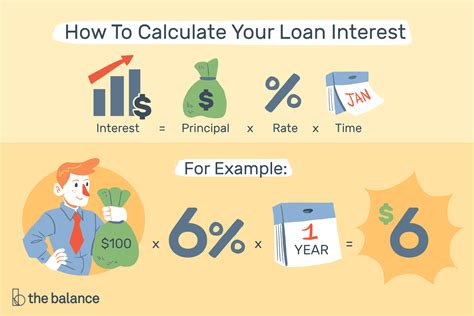

The 0% promotional APR is a temporary interest-free period offered by financial institutions for a specific duration, typically ranging from six months to a year. This promotional rate is attractive to patients as it allows them to finance their cosmetic surgery without incurring any interest charges during the promotional period.

Key benefits of 0% promotional APR for cosmetic surgery financing:

a. No interest charges: Patients can enjoy the full amount of the surgery cost without any additional interest expenses, making it a cost-effective option.

b. Budgeting flexibility: With no immediate interest payments, patients can better plan and manage their finances, ensuring a smooth recovery period.

c. Competitive rates: Financial institutions often offer competitive promotional rates, making it an attractive choice for cosmetic surgery financing.

2. The Potential Traps of Medical Credit Cards

Medical credit cards are specifically designed for healthcare expenses, including cosmetic surgery. While they may seem convenient, there are several traps that patients should be aware of.

a. High interest rates: After the promotional period ends, medical credit cards typically have higher interest rates compared to other credit cards. This can lead to substantial interest charges if the balance is not paid off in full.

b. Limited promotional period: Unlike the extended promotional period of 0% APR financing, medical credit cards usually offer a shorter promotional period, making it more challenging to pay off the balance before the interest rate increases.

c. Hidden fees: Some medical credit cards may come with hidden fees, such as annual fees, balance transfer fees, or cash advance fees, which can further burden the patient’s financial situation.

3. Comparing the Two Options

When comparing 0% promotional APR for cosmetic surgery financing with medical credit cards, it’s essential to consider the following factors:

a. Duration of the promotional period: 0% promotional APR offers a longer promotional period, providing more time for patients to pay off the balance without incurring interest charges.

b. Interest rates: 0% promotional APR has no interest charges during the promotional period, whereas medical credit cards often have higher interest rates after the promotional period ends.

c. Fees: Medical credit cards may have hidden fees, whereas 0% promotional APR financing usually doesn’t involve additional fees.

Conclusion:

When financing cosmetic surgery, patients should carefully evaluate their options to ensure they make an informed decision. The 0% promotional APR for cosmetic surgery financing offers a cost-effective solution with no interest charges during the promotional period. On the other hand, medical credit cards can come with higher interest rates and hidden fees, potentially leading to a more challenging financial situation. By understanding the differences and potential traps, individuals can choose the financing option that best suits their needs and budget.