Introduction:

Debt consolidation is a popular financial strategy that can help individuals manage their debts more effectively. By combining multiple debts into a single payment, borrowers can simplify their finances and potentially reduce their overall interest costs. In this article, we will explore the math behind debt consolidation and compare the savings between a 15% APR loan and a 22% credit card interest rate using a savings calculator.

Understanding Debt Consolidation:

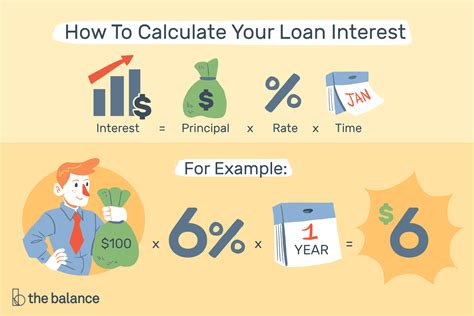

Debt consolidation involves taking out a new loan to pay off existing debts. The goal is to replace multiple high-interest debts with a single, lower-interest loan. This can help borrowers reduce their monthly payments, pay off their debts faster, and save money on interest charges.

15% APR Loan:

Let’s consider a 15% Annual Percentage Rate (APR) loan. An APR is the cost of borrowing money, expressed as a yearly rate. In this case, the loan has a 15% interest rate.

22% Credit Card Interest Rate:

Now, let’s compare this to a 22% credit card interest rate. Credit card interest rates are often higher than personal loans, making them a less favorable option for debt consolidation.

Savings Calculator:

To determine the savings between these two options, we will use a savings calculator. This tool will help us calculate the total interest paid over a specific period, allowing us to compare the two scenarios.

Assumptions:

For this example, let’s assume the following:

– Borrower has $10,000 in credit card debt with a 22% interest rate.

– Borrower takes out a $10,000 loan with a 15% interest rate.

– The borrower will pay off the loan in 5 years.

Calculating Savings:

1. 15% APR Loan:

– Monthly payment: $193.85

– Total interest paid: $2,955.00

– Total paid: $12,955.00

2. 22% Credit Card Interest Rate:

– Monthly payment: $224.47

– Total interest paid: $7,716.00

– Total paid: $17,716.00

As we can see, by consolidating the $10,000 credit card debt into a 15% APR loan, the borrower saves $4,761.00 in interest charges over 5 years.

Conclusion:

Debt consolidation can be an effective strategy to manage debt and save money on interest charges. By comparing the savings between a 15% APR loan and a 22% credit card interest rate using a savings calculator, borrowers can make informed decisions about their financial future. In this example, consolidating the debt into a 15% APR loan resulted in significant savings, making it a more favorable option for the borrower.