Introduction:

The Public Service Loan Forgiveness (PSLF) program is a federal initiative designed to help those working in public service roles to have their student loans forgiven after a certain period of time. However, the application process can be complex and sometimes even result in rejection. This article outlines 120 payment certification audit tactics to help borrowers navigate PSLF rejection appeals and increase their chances of loan forgiveness.

1. Gather all relevant documentation:

Before starting the appeal process, ensure that you have all necessary documentation, including proof of your employment in a public service role, your loan history, and any communication from the Department of Education.

2. Review the rejection letter:

Read the rejection letter carefully to understand the reasons for your PSLF application being denied. Pay close attention to specific criteria that were not met.

3. Identify errors or missing information:

Check if there are any errors or missing information in your application that could have led to the rejection. Address these issues promptly.

4. Request an appeal packet:

Contact your loan servicer or the Department of Education to request an appeal packet, which will provide instructions on how to submit your appeal.

5. Review the appeal packet thoroughly:

Familiarize yourself with the appeal process and requirements. Ensure you understand the deadlines and necessary documentation.

6. Provide additional evidence:

If the rejection letter mentions specific issues, gather additional evidence to support your claim. This may include employment verification, proof of payments, and other relevant documents.

7. Write a compelling appeal letter:

Compose a well-structured appeal letter addressing the reasons for your rejection. Be concise, professional, and persuasive in your arguments.

8. Include a summary of your loan repayment history:

Highlight your repayment history, emphasizing any positive trends or periods of consecutive payments.

9. Explain any gaps in employment or payments:

If there were any gaps in your employment or loan payments, provide explanations and proof of your efforts to comply with the PSLF program requirements.

10. Provide evidence of hardship:

If applicable, include any evidence of financial hardship or extenuating circumstances that may have impacted your ability to make payments.

11. Consult with an attorney or financial advisor:

Seek professional advice to ensure that your appeal is thorough and meets all necessary requirements.

12. Follow the appeal packet guidelines:

Ensure that you follow the guidelines provided in the appeal packet to the letter. This includes deadlines, submission methods, and formatting requirements.

13. Keep copies of all documents:

Maintain copies of all documents submitted during the appeal process for your records.

14. Follow up on your appeal:

Stay proactive by following up with your loan servicer or the Department of Education to track the progress of your appeal.

15. Provide additional information if requested:

Be prepared to provide any additional information requested by your loan servicer or the Department of Education during the appeal process.

16. Consider requesting a reconsideration:

If your appeal is denied, consider requesting a reconsideration. This involves submitting the same or additional information to address the original concerns.

17. Seek guidance from the Department of Education:

If you are unsure about any aspect of the appeal process, don’t hesitate to reach out to the Department of Education for guidance.

18. Document communication:

Keep a record of all communication with your loan servicer, the Department of Education, and any other relevant parties throughout the appeal process.

19. Stay informed about updates:

Monitor the PSLF program for any updates or changes that may impact your appeal.

20. Prepare for a possible denial:

Be mentally prepared for the possibility of your appeal being denied. If this occurs, consider seeking assistance from a consumer credit counseling service or exploring other loan forgiveness options.

21. Stay persistent:

Persistence is key in the PSLF appeal process. Follow up regularly and stay informed about the status of your appeal.

22. Keep your loan servicer updated:

Ensure that your loan servicer is aware of your ongoing appeal and any updates you receive.

23. Monitor your loan account:

Regularly check your loan account to ensure that the payment certification process is running smoothly and that there are no discrepancies.

24. Review the payment certification process:

Familiarize yourself with the payment certification process to understand how it may have affected your PSLF eligibility.

25. Check for errors in your loan account:

If you notice any errors in your loan account, address them immediately to avoid further complications.

26. Verify your loan servicer:

Ensure that your loan is being serviced by an authorized PSLF participating loan servicer.

27. Seek clarification on confusing terms:

If any terms in your loan agreement or the PSLF program are unclear, seek clarification from your loan servicer or the Department of Education.

28. Keep your contact information updated:

Ensure that your loan servicer has your current contact information to facilitate communication during the appeal process.

29. Review your income-driven repayment plan:

If you are on an income-driven repayment plan, verify that your plan is correctly set up and that you are meeting the necessary requirements.

30. Stay organized:

Maintain an organized record of all your documents, communications, and actions taken during the appeal process.

31. Utilize online resources:

Take advantage of online resources, such as the Department of Education’s PSLF website, to gather information and guidance.

32. Stay informed about changes to the PSLF program:

Keep abreast of any changes to the PSLF program that may impact your eligibility or the appeal process.

33. Seek help from your employer:

If you are working in a public service role, consult with your employer to ensure that your employment meets the necessary criteria for PSLF eligibility.

34. Reach out to your alma mater:

Contact your alma mater’s financial aid office for assistance with understanding the PSLF program and the appeal process.

35. Review your loan terms:

Ensure that you have a clear understanding of your loan terms and how they relate to the PSLF program.

36. Stay informed about forgiveness options:

Explore other loan forgiveness options if PSLF is not available or not applicable to your situation.

37. Consider refinancing your loans:

Evaluate the possibility of refinancing your loans with a private lender if PSLF is not available or if you anticipate difficulties with the appeal process.

38. Stay focused on your primary responsibilities:

While appealing your PSLF rejection, prioritize your primary responsibilities, such as paying your bills and maintaining financial stability.

39. Utilize social media for support:

Join PSLF-related social media groups or forums to connect with others who have experienced similar situations and seek support and advice.

40. Attend informational webinars or workshops:

Take advantage of webinars or workshops offered by the Department of Education or other organizations to learn more about PSLF and the appeal process.

41. Review your payment history:

Check your payment history to ensure that all payments have been reported correctly and that you meet the necessary requirements for PSLF.

42. Reach out to your loan servicer for guidance:

If you have questions about the PSLF program or the appeal process, contact your loan servicer for clarification and assistance.

43. Stay optimistic:

Maintain a positive outlook throughout the appeal process and believe in your chances of success.

44. Keep your emotions in check:

Stay composed and focused, even if you face setbacks or feel frustrated during the appeal process.

45. Seek support from family and friends:

Lean on your support network for encouragement and moral support throughout the appeal process.

46. Review the PSLF program guidelines:

Familiarize yourself with the PSLF program guidelines to understand the specific requirements and eligibility criteria.

47. Keep track of deadlines:

Make sure you are aware of all deadlines associated with the appeal process and meet them accordingly.

48. Stay persistent in your follow-up:

Regularly follow up with your loan servicer or the Department of Education to ensure that your appeal is being processed promptly.

49. Keep your records updated:

Ensure that all your records are up-to-date and organized to avoid any confusion during the appeal process.

50. Stay focused on the end goal:

Remember that the ultimate goal of the appeal process is to secure loan forgiveness and maintain financial stability.

51. Explore alternative loan forgiveness programs:

If PSLF is not available to you, research other loan forgiveness programs that may be suitable for your situation.

52. Stay proactive in resolving any issues:

Take an active role in resolving any issues or discrepancies in your loan account to ensure a smooth appeal process.

53. Maintain good standing with your loan servicer:

Keep your account in good standing by making payments on time and addressing any concerns promptly.

54. Review your income tax returns:

Ensure that your income tax returns accurately reflect your income, as this may affect your income-driven repayment plan.

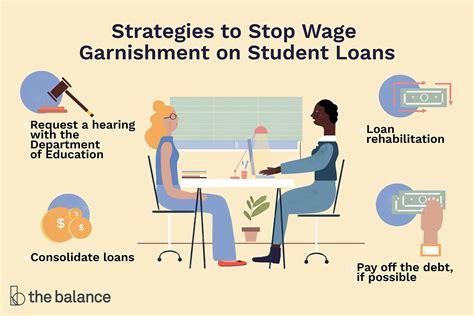

55. Stay informed about loan consolidation options:

Consider loan consolidation if it could potentially improve your chances of PSLF eligibility or simplify the appeal process.

56. Reach out to your senators or representatives:

Contact your senators or representatives to advocate for changes to the PSLF program or to seek their assistance in resolving any issues you may face.

57. Review your eligibility for PSLF:

Confirm that you meet all the eligibility criteria for PSLF, including working in a public service role and making qualifying payments.

58. Keep track of your qualifying payments:

Maintain a record of all qualifying payments you have made towards your loans to ensure that you meet the PSLF requirements.

59. Stay informed about loan forgiveness forgiveness:

Familiarize yourself with the loan forgiveness process and any requirements or conditions associated with it.

60. Keep an open line of communication with your loan servicer:

Regularly communicate with your loan servicer to address any concerns or questions that arise during the appeal process.

61. Stay patient throughout the appeal process:

Understand that the appeal process can take time, and patience is key to a successful outcome.

62. Seek assistance from a consumer credit counseling service:

If you are struggling to navigate the appeal process, consider seeking assistance from a consumer credit counseling service.

63. Review your credit report:

Ensure that your credit report accurately reflects your loan history and that there are no errors or discrepancies that could impact your appeal.

64. Stay informed about changes to your loan terms:

Keep an eye on any changes to your loan terms that may affect your eligibility for PSLF or the appeal process.

65. Maintain a positive attitude:

Maintain a positive attitude throughout the appeal process, as a positive mindset can help you stay motivated and focused.

66. Seek guidance from a financial advisor:

Consider consulting with a financial advisor to gain insights into your financial situation and potential loan forgiveness options.

67. Stay compliant with the PSLF program requirements:

Ensure that you remain compliant with all PSLF program requirements throughout the appeal process.

68. Keep track of your appeals:

Maintain a record of all appeals you submit, along with any responses or communications received from the Department of Education or your loan servicer.

69. Stay informed about any new appeals:

Keep an eye out for any new appeals or challenges to the PSLF program that may impact your eligibility or the appeal process.

70. Stay focused on your financial goals:

Remain committed to achieving your financial goals, such as securing loan forgiveness through the PSLF program.

71. Seek support from online communities:

Join online communities or forums dedicated to PSLF to connect with others who have faced similar challenges and share advice and experiences.

72. Stay up-to-date with the PSLF program changes:

Stay informed about any changes or updates to the PSLF program that may affect your eligibility or the appeal process.

73. Keep track of your loan balance:

Monitor your loan balance to ensure that it is accurately reported and that you meet the PSLF requirements.

74. Stay persistent in seeking loan forgiveness:

Don’t give up on seeking loan forgiveness, even if the appeal process is lengthy or challenging.

75. Stay compliant with the payment certification process:

Ensure that you are meeting the necessary requirements for the payment certification process to maintain your eligibility for PSLF.

76. Stay focused on resolving any issues:

If you encounter any issues or discrepancies during the appeal process, take steps to resolve them promptly to avoid further delays.

77. Stay motivated and determined:

Maintain motivation and determination throughout the appeal process to achieve a successful outcome.

78. Keep track of your progress:

Regularly review your progress and update your records to ensure that you are meeting all necessary requirements for PSLF eligibility.

79. Stay compliant with income-driven repayment plans:

If you are on an income-driven repayment plan, ensure that you are meeting the necessary requirements and that your payments are being reported correctly.

80. Stay informed about your rights and responsibilities:

Understand your rights and responsibilities under the PSLF program and the appeal process.

81. Stay persistent in your follow-up:

Don’t hesitate to follow up with your loan servicer or the Department of Education to ensure that your appeal is being processed promptly.

82. Keep an organized record of all communications:

Maintain a detailed record of all communications with your loan servicer, the Department of Education, and any other relevant parties throughout the appeal process.

83. Stay informed about changes to the PSLF program:

Keep abreast of any changes to the PSLF program that may impact your eligibility or the appeal process.

84. Stay committed to your financial goals:

Remain committed to achieving your financial goals, such as securing loan forgiveness through the PSLF program.

85. Stay positive and hopeful:

Maintain a positive and hopeful outlook throughout the appeal process to help you stay motivated and focused.

86. Seek assistance from a legal professional if necessary:

If you encounter legal issues or challenges during the appeal process, consider seeking assistance from a legal professional who specializes in education loan law.

87. Stay focused on your primary responsibilities:

Prioritize your primary responsibilities, such as paying your bills and maintaining financial stability, while navigating the PSLF appeal process.

88. Stay proactive in seeking loan forgiveness:

Take an active role in seeking loan forgiveness by following all necessary steps and meeting all required deadlines.

89. Stay motivated and determined:

Maintain motivation and determination throughout the appeal process to achieve a successful outcome.

90. Stay informed about any new appeals or challenges to the PSLF program:

Keep an eye out for any new appeals or challenges to the PSLF program that may impact your eligibility or the appeal process.

91. Stay committed to your financial goals:

Remain committed to achieving your financial goals, such as securing loan forgiveness through the PSLF program.

92. Stay positive and hopeful:

Maintain a positive and hopeful outlook throughout the appeal process to help you stay motivated and focused.

93. Seek support from family and friends:

Lean on your support network for encouragement and moral support throughout the appeal process.

94. Stay informed about changes to your loan terms:

Keep an eye on any changes to your loan terms that may affect your eligibility for PSLF or the appeal process.

95. Stay motivated and determined:

Maintain motivation and determination throughout the appeal process to achieve a successful outcome.

96. Stay informed about the PSLF program guidelines:

Familiarize yourself with the PSLF program guidelines to understand the specific requirements and eligibility criteria.

97. Stay organized:

Maintain an organized record of all your documents, communications, and actions taken during the appeal process.

98. Stay persistent in seeking loan forgiveness:

Don’t give up on seeking loan forgiveness, even if the appeal process is lengthy or challenging.

99. Stay compliant with the payment certification process:

Ensure that you are meeting the necessary requirements for the payment certification process to maintain your eligibility for PSLF.

100. Stay focused on resolving any issues:

If you encounter any issues or discrepancies during the appeal process, take steps to resolve them promptly to avoid further delays.

101. Stay motivated and determined:

Maintain motivation and determination throughout the appeal process to achieve a successful outcome.

102. Stay informed about your rights and responsibilities:

Understand your rights and responsibilities under the PSLF program and the appeal process.

103. Stay proactive in seeking loan forgiveness:

Take an active role in seeking loan forgiveness by following all necessary steps and meeting all required deadlines.

104. Stay committed to your financial goals:

Remain committed to achieving your financial goals, such as securing loan forgiveness through the PSLF program.

105. Stay positive and hopeful:

Maintain a positive and hopeful outlook throughout the appeal process to help you stay motivated and focused.

106. Seek assistance from a legal professional if necessary:

If you encounter legal issues or challenges during the appeal process, consider seeking assistance from a legal professional who specializes in education loan law.

107. Stay focused on your primary responsibilities:

Prioritize your primary responsibilities, such as paying your bills and maintaining financial stability, while navigating the PSLF appeal process.

108. Stay proactive in seeking loan forgiveness:

Take an active role in seeking loan forgiveness by following all necessary steps and meeting all required deadlines.

109. Stay motivated and determined:

Maintain motivation and determination throughout the appeal process to achieve a successful outcome.

110. Stay informed about any new appeals or challenges to the PSLF program:

Keep an eye out for any new appeals or challenges to the PSLF program that may impact your eligibility or the appeal process.

111. Stay committed to your financial goals:

Remain committed to achieving your financial goals, such as securing loan forgiveness through the PSLF program.

112. Stay positive and hopeful:

Maintain a positive and hopeful outlook throughout the appeal process to help you stay motivated and focused.

113. Seek support from family and friends:

Lean on your support network for encouragement and moral support throughout the appeal process.

114. Stay informed about changes to your loan terms:

Keep an eye on any changes to your loan terms that may affect your eligibility for PSLF or the appeal process.

115. Stay motivated and determined:

Maintain motivation and determination throughout the appeal process to achieve a successful outcome.

116. Stay informed about the PSLF program guidelines:

Familiarize yourself with the PSLF program guidelines to understand the specific requirements and eligibility criteria.

117. Stay organized:

Maintain an organized record of all your documents, communications, and actions taken during the appeal process.

118. Stay persistent in seeking loan forgiveness:

Don’t give up on seeking loan forgiveness, even if the appeal process is lengthy or challenging.

119. Stay compliant with the payment certification process:

Ensure that you are meeting the necessary requirements for the payment certification process to maintain your eligibility for PSLF.

120. Stay focused on resolving any issues:

If you encounter any issues or discrepancies during the appeal process, take steps to resolve them promptly to avoid further delays.

Conclusion:

Navigating PSLF rejection appeals can be challenging, but by following these 120 payment certification audit tactics, borrowers can increase their chances of securing loan forgiveness. Staying organized, persistent, and proactive throughout the appeal process is crucial to achieving a successful outcome. Remember to seek assistance from professionals, utilize online resources, and stay informed about the PSLF program and any changes or updates that may impact your eligibility.