Introduction:

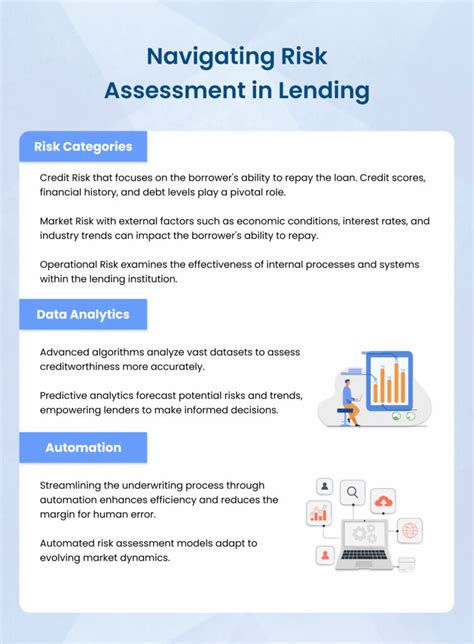

When applying for a personal loan, understanding how lenders calculate risk scores is crucial. Lenders use these scores to determine the likelihood of a borrower defaulting on the loan. In this article, we will uncover the secrets behind personal loan underwriting and shed light on the factors that contribute to lenders’ risk assessments.

1. Credit Score:

The most significant factor in calculating a risk score is the borrower’s credit score. This score reflects the borrower’s creditworthiness and is based on their credit history, including payment history, credit utilization, length of credit history, types of credit used, and new credit.

– Payment History: Lenders analyze how consistently the borrower has paid their bills on time. A history of late payments or defaults can significantly impact the risk score.

– Credit Utilization: The ratio of the borrower’s credit card balances to their credit limits is also considered. A high credit utilization can raise red flags for lenders.

– Length of Credit History: The longer the borrower has maintained credit accounts, the better. It demonstrates stability and responsible credit management.

– Types of Credit Used: Lenders look at the diversity of credit accounts the borrower has, such as credit cards, loans, and mortgages. A mix of different credit types can positively influence the risk score.

– New Credit: Applying for multiple new lines of credit within a short period can negatively impact the risk score, as it may indicate financial stress or a higher risk of default.

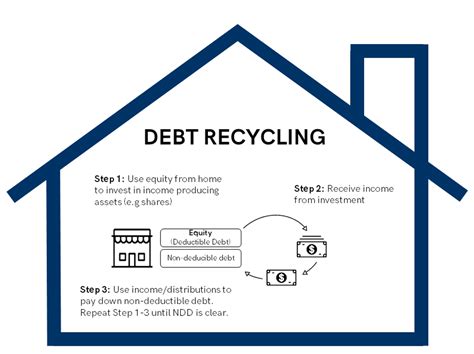

2. Debt-to-Income Ratio:

Another crucial factor in calculating risk scores is the borrower’s debt-to-income (DTI) ratio. This ratio compares the borrower’s monthly debt payments to their gross monthly income. Lenders generally prefer a DTI ratio of 36% or lower, indicating that the borrower can comfortably manage their debt obligations.

3. Employment and Income:

Lenders assess the stability and reliability of the borrower’s employment and income. Factors such as length of employment, industry, and income level are considered. Borrowers with a stable employment history and consistent income are viewed as lower risk.

4. Financial Behavior:

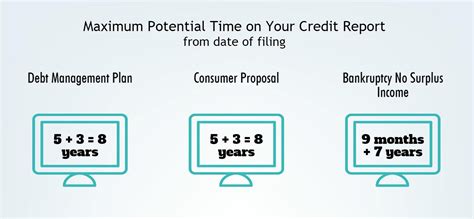

Lenders may also consider the borrower’s financial behavior, such as the presence of liens, judgments, or bankruptcy. These factors can indicate financial challenges and raise concerns about the borrower’s ability to repay the loan.

5. Personal Information:

Lenders may also take into account personal information, such as the borrower’s age, marital status, and dependents. While these factors may not directly impact the risk score, they can provide additional insights into the borrower’s financial situation and stability.

Conclusion:

Understanding how lenders calculate risk scores can help borrowers improve their chances of securing a personal loan. By focusing on maintaining a good credit score, managing debt responsibly, and demonstrating financial stability, borrowers can present themselves as lower risk to lenders. Keep in mind that lenders’ underwriting criteria may vary, so it’s essential to research and compare different lenders to find the best option for your needs.