Introduction:

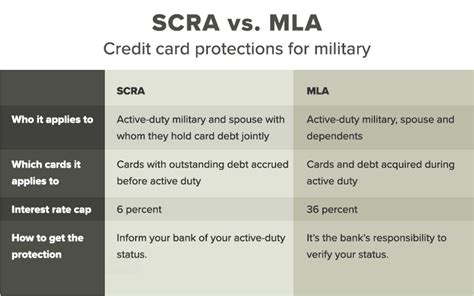

The Servicemembers Civil Relief Act (SCRA) is a federal law designed to protect active-duty military personnel from financial hardships during their service. One of the key provisions of SCRA is the 6% rate cap on auto loans. This article delves into the enforcement of this rate cap, highlighting the importance of protecting military members from excessive interest rates.

I. Background on SCRA and the 6% Rate Cap

The Servicemembers Civil Relief Act was enacted in 2003 to provide legal protections to military personnel and their families. One of the primary goals of SCRA is to prevent financial exploitation of military members during their service. The 6% rate cap on auto loans is a significant aspect of this protection, ensuring that service members are not subjected to exorbitant interest rates during their service.

II. The Importance of the 6% Rate Cap

The 6% rate cap is crucial for military personnel due to several reasons:

1. Financial Stability: The cap helps service members maintain financial stability by preventing excessive debt accumulation, which can lead to long-term financial hardships.

2. Budgeting: With a predictable interest rate, military members can better plan their budgets, ensuring they can afford their auto loans without the risk of falling into debt.

3. Fairness: The 6% rate cap ensures that military personnel are treated fairly, as they may face unique challenges and responsibilities during their service.

III. Enforcement of the 6% Rate Cap

Enforcing the 6% rate cap is essential to ensure that military members receive the protections they are entitled to under SCRA. Here are some key aspects of enforcement:

1. Lender Compliance: Financial institutions and lenders are required to adhere to the 6% rate cap when offering auto loans to active-duty military personnel. Non-compliance can result in penalties and legal action.

2. Consumer Awareness: Military members and their families must be informed about their rights under SCRA, including the 6% rate cap. This awareness helps prevent lenders from taking advantage of unsuspecting service members.

3. Regulatory Oversight: Federal and state regulators play a crucial role in enforcing the 6% rate cap. They monitor lenders and investigate complaints to ensure compliance with SCRA.

4. Legal Action: When violations occur, military members can seek legal action against lenders who fail to comply with the 6% rate cap. This action can result in compensation and penalties for the lender.

IV. Challenges in Enforcing the 6% Rate Cap

Despite the importance of the 6% rate cap, enforcing it can be challenging. Some of the challenges include:

1. Limited Resources: Regulatory agencies may face budget constraints, making it difficult to thoroughly investigate and enforce SCRA violations.

2. Complexity: Auto loans can be complex, making it challenging to determine if a lender has violated the 6% rate cap.

3. Lack of Awareness: Some military members may not be fully aware of their rights under SCRA, making it harder to identify violations.

Conclusion:

The 6% rate cap on auto loans is a vital provision of the Servicemembers Civil Relief Act, offering significant financial protections to active-duty military personnel. Ensuring the enforcement of this rate cap is crucial for maintaining the financial well-being of service members and their families. By addressing challenges and increasing awareness, we can work towards a more equitable and fair financial system for our nation’s heroes.