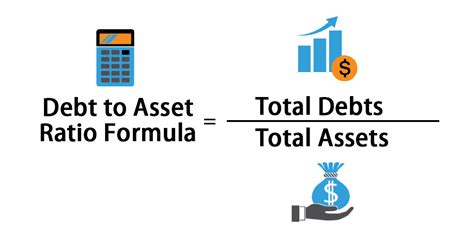

In the complex world of finance, understanding and managing the debt-to-asset ratio is crucial for individuals and businesses alike. This ratio is a measure of a company’s financial leverage and is calculated by dividing total liabilities by total assets. Similarly, for individuals, it’s an essential metric to assess the level of risk associated with their debt and investment decisions. In this article, we’ll explore how leveraging personal property can help balance your debt-to-asset ratio for better rates.

**Understanding the Debt-to-Asset Ratio**

The debt-to-asset ratio is a vital financial indicator that reveals how much of a company’s assets are financed through debt. For individuals, this ratio is equally important as it helps to determine how much debt you can handle in relation to your assets. A high debt-to-asset ratio can indicate financial instability, while a low ratio may suggest a conservative approach to debt management.

**Balancing the Ratio with Personal Property**

One way to balance your debt-to-asset ratio is by leveraging personal property. By using personal assets, such as a home, car, or investment property, as collateral, you can secure loans at more favorable rates. Here’s how it works:

1. **Collateralization**: When you use personal property as collateral, you provide a lender with a tangible asset that they can seize in case you default on the loan. This reduces the lender’s risk, and in turn, you may receive better interest rates and terms.

2. **Home Equity**: For homeowners, tapping into home equity can be an effective way to lower your debt-to-asset ratio. By refinancing your mortgage or taking out a home equity loan, you can pay off high-interest debt, thereby reducing your overall debt burden.

3. **Investment Properties**: If you own investment properties, you can leverage their value to secure loans for personal expenses or business ventures. This approach can help you manage your debt-to-asset ratio while generating additional income from rental properties.

4. **Asset Diversification**: Ensuring that your personal property is well-diversified can also help balance your debt-to-asset ratio. By having a mix of assets, you can reduce the risk of overexposure to a single investment, which can negatively impact your ratio.

**Benefits of Leveraging Personal Property**

Using personal property to balance your debt-to-asset ratio offers several benefits:

– **Lower Interest Rates**: By reducing the risk for lenders, leveraging personal property can result in lower interest rates on loans.

– **Improved Credit Score**: Successfully managing debt using personal property as collateral can help improve your credit score, which is crucial for securing future loans or lines of credit.

– **Financial Flexibility**: Leveraging personal property can provide you with the financial flexibility to pursue new opportunities, whether it’s investing in a business venture or consolidating high-interest debt.

**Conclusion**

Balancing your debt-to-asset ratio is essential for maintaining financial stability and securing better rates on loans. By leveraging personal property, you can effectively manage your debt and investment decisions, leading to a healthier financial profile. However, it’s crucial to approach this strategy with caution and ensure that you maintain a sustainable level of debt in relation to your assets.