Introduction:

As a business grows, managing accounts receivable (AR) can become a complex and time-consuming task. To streamline this process, many businesses opt for either AR financing or factoring services. Both options offer benefits, but they also come with their own set of costs. This article aims to compare the costs associated with a 3% fee AR financing and a 15% discount rate factoring service, providing you with a comprehensive cost analysis to help you make an informed decision for your business.

AR Financing:

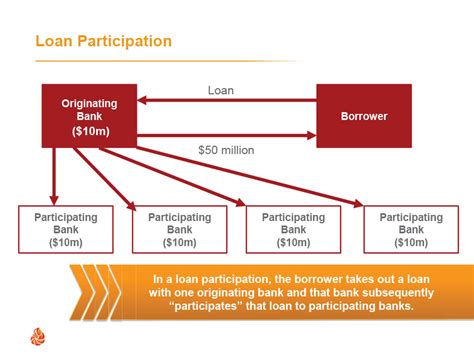

AR financing is a type of funding that allows businesses to convert their receivables into cash by selling them to a third-party financier. The financier then manages the AR collection process on the business’s behalf. Here’s a breakdown of the costs involved in AR financing:

1. 3% fee: This fee is charged by the financier for providing the service. It is usually calculated as a percentage of the total receivables sold to the financier.

2. Interest rate: AR financing often involves an interest rate on the funds advanced, which can vary depending on the creditworthiness of the business and the financier’s policies.

3. Origination fee: Some financiers may charge an upfront fee for setting up the AR financing account.

4. Ongoing fees: Additional fees may be charged for services like account management, reporting, and customer support.

Factoring:

Factoring is another popular method for managing AR, where a business sells its receivables to a factoring company at a discount. The following costs are associated with factoring:

1. 15% discount rate: This is the fee charged by the factoring company for purchasing the receivables. The discount rate is a percentage of the total receivables sold and is the primary cost of using a factoring service.

2. Reserve: A reserve account may be required as a form of security. This account holds a portion of the proceeds from the factored receivables and is released back to the business upon completion of the collection process.

3. Bad debt protection: Factoring companies typically offer bad debt protection, which can result in additional fees.

4. Other fees: Similar to AR financing, factoring may also involve interest rates, origination fees, and ongoing fees.

Cost Analysis:

When comparing the costs of a 3% fee AR financing to a 15% discount rate factoring, several factors must be considered:

1. Speed of cash flow: AR financing can provide businesses with faster access to cash, which can be crucial for meeting financial obligations and maintaining growth. However, this advantage may not always outweigh the higher fee.

2. Discount rate: A higher discount rate may mean a larger percentage of the receivables is lost in the transaction, reducing the overall value to the business.

3. Creditworthiness: The interest rates and fees associated with both AR financing and factoring can vary based on the creditworthiness of the business. Higher-rated businesses may be offered better terms and lower costs.

4. Long-term cost savings: Some businesses may find that the benefits of working with a factoring company, such as improved cash flow and reduced workload, outweigh the higher discount rate.

Conclusion:

Choosing between AR financing and factoring requires careful consideration of the costs involved, as well as the benefits and drawbacks of each option. While a 3% fee AR financing may offer lower costs upfront, a 15% discount rate factoring service could provide a more substantial discount on receivables. Ultimately, it is essential to assess the specific needs and financial situation of your business to determine which option is more suitable.