Introduction:

In times of economic downturn, businesses often face financial challenges, including the renegotiation of loan covenants and the consideration of EBITDA-C add-backs. This article explores the dynamics behind these strategies during a recession, providing insights into how companies can navigate through tough financial periods.

1. Understanding Loan Covenants:

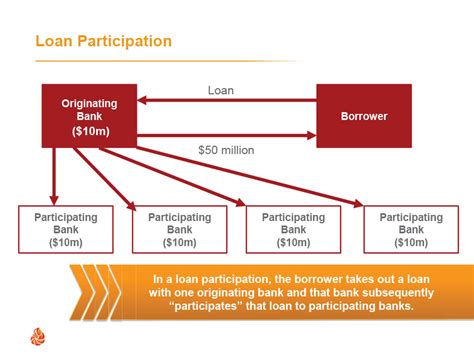

Loan covenants are conditions set by lenders to protect their interests in the event that borrowers fail to meet certain financial requirements. These requirements can include maintaining a minimum debt-to-equity ratio, maintaining a specific level of working capital, or ensuring a minimum level of earnings before interest, taxes, depreciation, and amortization (EBITDA).

2. Renegotiating Loan Covenants:

During a recession, many businesses find themselves struggling to meet the stringent loan covenant requirements. In such situations, renegotiating these covenants becomes crucial. Here are some key aspects to consider when renegotiating loan covenants:

a. Communication: Establishing open and transparent communication with lenders is essential. This helps build trust and fosters a collaborative approach to finding mutually beneficial solutions.

b. Financial Analysis: Provide lenders with a detailed analysis of your company’s financial situation, highlighting any short-term challenges and long-term prospects. This will help lenders understand the reasons behind the covenant breaches and their potential impact on the business.

c. Alternative Solutions: Explore alternative solutions to meet the covenant requirements, such as extending the maturity date of the loan, adjusting the interest rate, or providing additional security.

3. EBITDA-C Add-Backs:

During a recession, businesses may face a decrease in earnings, making it difficult to meet the EBITDA covenant requirements. One way to address this issue is by considering EBITDA-C add-backs. Here’s an overview of EBITDA-C add-backs:

a. EBITDA-C: EBITDA-C is an adjusted version of EBITDA, which includes the cost of capital expenditures (CapEx) and certain non-operating expenses. This adjustment provides a more accurate representation of a company’s profitability.

b. Add-Backs: By adding back certain expenses, such as depreciation, amortization, or interest, a company can demonstrate a higher level of earnings, potentially satisfying the EBITDA covenant requirements.

c. Risks: While EBITDA-C add-backs can be a viable solution, it’s crucial to carefully consider the risks involved. Adding back expenses can sometimes mask underlying financial issues and may not provide a true reflection of the company’s profitability.

4. The Impact of Renegotiation and EBITDA-C Add-Backs:

Renegotiating loan covenants and considering EBITDA-C add-backs during a recession can have several implications for a business:

a. Financial Health: Successfully renegotiating loan covenants and implementing EBITDA-C add-backs can help stabilize a company’s financial situation, allowing it to continue operating and invest in future growth.

b. Lender Relations: Open communication and collaboration during the renegotiation process can strengthen the relationship between a business and its lenders, fostering a more supportive partnership.

c. Market Perception: Demonstrating the ability to navigate financial challenges and work with lenders can enhance a company’s reputation and attractiveness to investors.

Conclusion:

During a recession, renegotiating loan covenants and considering EBITDA-C add-backs can be vital strategies for businesses facing financial challenges. By understanding the dynamics behind these strategies and taking a proactive approach, companies can navigate through tough economic times and secure a stronger financial future.