Introduction:

When it comes to refinancing equipment, understanding the depreciation schedules is crucial for making informed financial decisions. Depreciation schedules determine the value of equipment over time, which in turn affects the terms of refinancing. This article compares the depreciation schedules for 7-year and 10-year terms, helping you evaluate which option is more beneficial for your business.

I. Depreciation Basics:

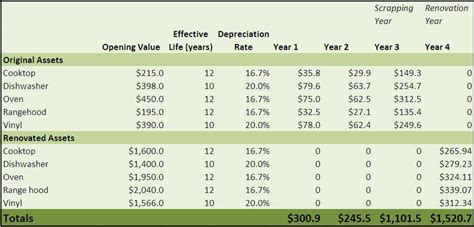

Depreciation is the process of allocating the cost of an asset over its useful life. It is an accounting method used to determine the decrease in value of an asset over time. There are several methods to calculate depreciation, such as straight-line, declining balance, and sum-of-the-years’ digits.

II. 7-Year Depreciation Schedule:

A 7-year depreciation schedule assumes that the asset will be fully depreciated by the end of the 7th year. Under the Modified Accelerated Cost Recovery System (MACRS), most equipment qualifies for a 7-year recovery period. Here’s how depreciation is typically calculated for a 7-year term:

1. Determine the asset’s cost basis: This is the original purchase price minus any applicable deductions, such as sales tax or shipping costs.

2. Calculate the annual depreciation expense: Divide the cost basis by 7 years.

3. Calculate the book value: Subtract the accumulated depreciation from the cost basis.

Example:

Suppose you purchase equipment for $10,000 with a 7-year depreciation schedule. The annual depreciation expense would be $1,428.57 ($10,000 / 7). After 7 years, the equipment’s book value would be $0.

III. 10-Year Depreciation Schedule:

A 10-year depreciation schedule assumes that the asset will be fully depreciated by the end of the 10th year. This schedule is typically used for assets with a longer useful life, such as buildings or certain types of equipment. Here’s how depreciation is calculated for a 10-year term:

1. Determine the asset’s cost basis: As in the 7-year schedule.

2. Calculate the annual depreciation expense: Divide the cost basis by 10 years.

3. Calculate the book value: Subtract the accumulated depreciation from the cost basis.

Example:

Continuing with the previous example, if the equipment has a 10-year depreciation schedule, the annual depreciation expense would be $1,000 ($10,000 / 10). After 10 years, the equipment’s book value would be $0.

IV. Refinancing Implications:

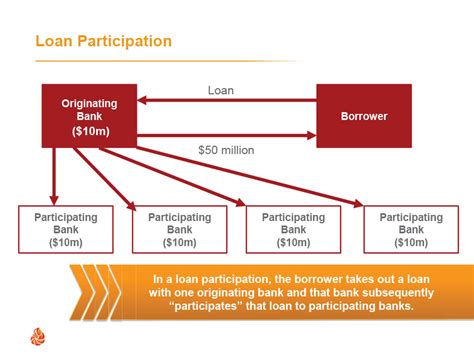

The depreciation schedule can significantly impact the refinancing of equipment. A shorter depreciation period, such as 7 years, might result in a lower book value, potentially leading to a higher loan-to-value (LTV) ratio and more favorable interest rates. Conversely, a longer depreciation period, such as 10 years, may result in a higher book value, affecting the LTV ratio and potentially increasing the cost of refinancing.

Conclusion:

Understanding the differences between 7-year and 10-year depreciation schedules is essential when refinancing equipment. The depreciation schedule can impact the loan-to-value ratio, interest rates, and overall cost of refinancing. By considering these factors, you can make an informed decision that aligns with your business’s financial goals.