Introduction:

Investing in a franchise can be an exciting venture, but navigating the financial aspects of the deal can be complex. One critical area that franchisees often grapple with is the issue of financing and the associated risks, particularly when it comes to personal guarantees versus corporate liability. This article delves into the common traps associated with franchisee financing, highlighting the differences between personal guarantees and corporate liability to help potential franchisees make informed decisions.

I. Understanding Franchisee Financing

A. Initial Investment

B. Ongoing Expenses

C. Franchise Royalties

D. Securing Financing

II. Personal Guarantee: The Risks and Benefits

A. What is a Personal Guarantee?

B. The Importance of Understanding the Terms

C. Benefits of Personal Guarantee:

1. Improved creditworthiness

2. Increased chances of securing financing

D. Risks of Personal Guarantee:

1. Risk of personal assets being seized in case of default

2. Liability for the full amount, even if the business is a corporation

III. Corporate Liability: An Overview

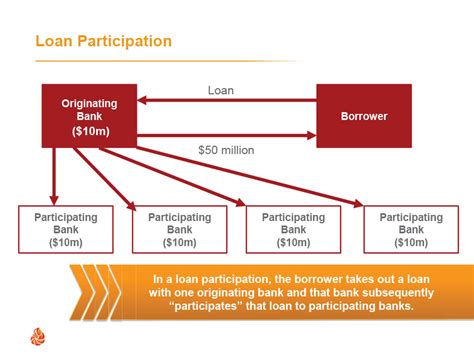

A. What is Corporate Liability?

B. The Distinction from Personal Liability

C. The Benefits of Corporate Liability:

1. Limits personal risk to the extent of the franchisee’s investment

2. Allows the franchisee to separate personal and business finances

IV. Common Traps in Franchisee Financing

A. Misunderstanding the terms of the loan agreement

B. Underestimating the risk associated with a personal guarantee

C. Lack of financial planning

D. Overleveraging the business

V. Mitigating Risks

A. Conducting thorough due diligence on the franchisor and financing options

B. Seeking legal advice and understanding the implications of personal guarantees

C. Maintaining a strong personal credit score

D. Implementing a solid financial plan for the business

VI. Conclusion

Franchisee financing is a critical aspect of entering the franchise world, and understanding the nuances between personal guarantees and corporate liability is vital. By being aware of the potential traps and risks, and taking steps to mitigate them, potential franchisees can make informed decisions that will protect their personal and business finances. Always consult with a financial advisor or legal professional before signing any franchise agreements or financing deals.