Introduction:

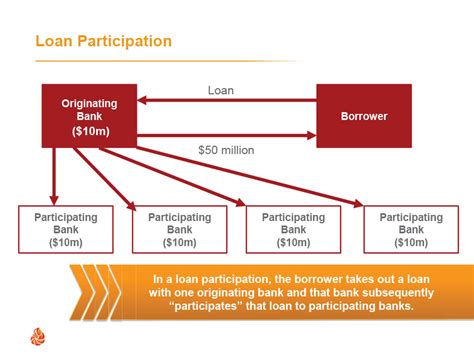

Inventory financing is a crucial aspect of business operations, particularly for companies that heavily rely on inventory to generate revenue. It involves securing funds from lenders to purchase inventory, which can help businesses maintain liquidity and meet their operational needs. This article will explore the key considerations in inventory financing, including the limits on financing, the valuation methods such as FIFO and LIFO, and the adjustments made by lenders.

1. Inventory Financing Limits:

Inventory financing limits are determined based on several factors, such as the business’s creditworthiness, industry, and the lender’s policies. Lenders typically assess the following aspects to establish the financing limits:

a. Financial statements: Reviewing the business’s financial statements, including the balance sheet, income statement, and cash flow statement, helps lenders evaluate the company’s financial health and ability to repay the loan.

b. Credit history: Lenders examine the business’s credit history to gauge its creditworthiness and risk profile. A strong credit history can lead to higher financing limits.

c. Industry standards: The specific industry’s average financing limits and risk factors play a role in determining the loan amount. Some industries may have higher limits due to their stable cash flow and lower risk.

d. Lender’s policies: Each lender has its own set of policies regarding inventory financing limits. It’s essential to understand these policies and compare them across different lenders to secure the best possible financing terms.

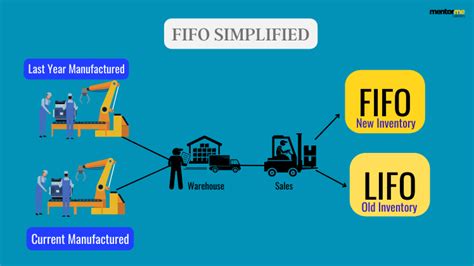

2. FIFO vs LIFO Valuation:

FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are two common inventory valuation methods used by businesses. These methods affect the cost of goods sold (COGS) and, consequently, the net income. Lenders may have different preferences for these valuation methods when considering inventory financing:

a. FIFO: Under FIFO, the oldest inventory is sold first. This method assumes that the cost of goods sold is based on the initial purchase prices. FIFO can result in a lower COGS, higher net income, and potentially a lower valuation of the inventory.

b. LIFO: In contrast, LIFO assumes that the most recent inventory is sold first. This method typically results in a higher COGS, lower net income, and a potentially higher valuation of the inventory.

Lenders may have preferences for one method over the other, depending on their risk tolerance and industry norms. It’s crucial for businesses to understand the implications of both FIFO and LIFO valuation methods and communicate their chosen method to the lender.

3. Lender Adjustments:

When considering inventory financing, lenders may make certain adjustments to the valuation and financing terms based on various factors:

a. Collateral value: Lenders may assess the collateral value of the inventory to determine the loan amount. If the inventory’s valuation is lower due to factors like FIFO or LIFO, the lender may adjust the loan amount accordingly.

b. Marketability: The marketability of the inventory can impact its valuation. If the inventory is in high demand or has a limited shelf life, lenders may adjust the financing terms to reflect the potential risk associated with selling the inventory.

c. Seasonality: For businesses with seasonal inventory fluctuations, lenders may consider the seasonality in their valuation and financing decisions.

Conclusion:

Inventory financing is a critical component of business operations, but it involves several important considerations. Understanding the limits on financing, the FIFO vs LIFO valuation methods, and the adjustments made by lenders can help businesses secure the best possible terms for their inventory financing needs. By working closely with lenders and understanding the intricacies of inventory financing, businesses can ensure their financial stability and continued growth.