In the dynamic world of multi-unit franchise financing, securing optimal capital structures and loan agreements is a paramount concern for both franchisees and lenders. One crucial aspect that often goes unnoticed is the positioning of franchise royalty collateral liens. This article delves into the intricacies of this positioning, highlighting its significance in multi-unit financing arrangements.

**Understanding Franchise Royalty Collateral Lien**

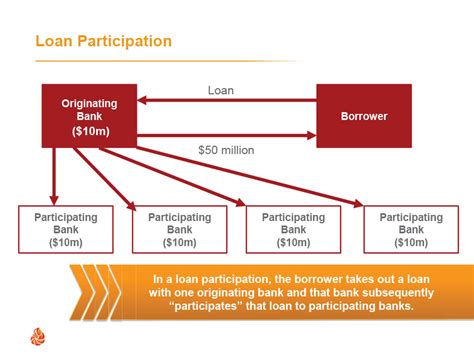

Before we delve into its positioning, let’s first understand what a franchise royalty collateral lien is. A collateral lien is a claim against the assets of a borrower, which secures a debt. In the context of a multi-unit franchise, a royalty collateral lien is a claim against the royalty payments that a franchisee makes to the franchisor. These payments are typically a percentage of the franchisee’s gross sales.

The purpose of a royalty collateral lien is to provide the franchisor with a form of security in case the franchisee defaults on the loan. It ensures that the franchisor can recover its losses if the franchisee fails to meet its financial obligations.

**Positioning of Franchise Royalty Collateral Lien**

In a multi-unit financing scenario, the positioning of the royalty collateral lien plays a vital role in determining the structure and terms of the loan. Here are a few key considerations:

1. **Seniority of the Lien**: The position of the royalty collateral lien relative to other liens (such as a first mortgage or a mezzanine loan) is crucial. A senior lien has a higher priority in terms of repayment, meaning the lender with the senior lien will be paid off before the lender with a junior lien. Franchisees and lenders should negotiate the seniority of the royalty collateral lien to ensure the franchisor’s interests are adequately protected.

2. **Loan Terms**: The terms of the loan, including interest rates, repayment schedules, and balloon payments, can be influenced by the position of the royalty collateral lien. A senior lien may allow the lender to negotiate more favorable terms, as it has a greater chance of recovering its investment in case of default.

3. **Impact on Operations**: The positioning of the royalty collateral lien can also affect the franchisee’s operational flexibility. A junior lien may require the franchisee to pay off the entire loan before they can receive royalty payments, which could strain the franchisee’s cash flow.

4. **Negotiation Power**: The position of the royalty collateral lien gives the franchisor some leverage in negotiations. Franchisors with a senior lien have more negotiating power, as they can demand stricter compliance and performance standards from the franchisee.

**Best Practices for Franchisees and Lenders**

To ensure a smooth and successful multi-unit financing arrangement, both franchisees and lenders should follow these best practices:

1. **Clear Communication**: Open and transparent communication between the franchisor, franchisee, and lender is essential in determining the optimal positioning of the royalty collateral lien.

2. **Legal Advice**: Both parties should consult with legal professionals to understand the legal implications and ensure that all agreements are compliant with applicable laws.

3. **Balanced Approach**: Franchisees should aim to secure a favorable position for the royalty collateral lien without unduly compromising their operational flexibility.

4. **Flexibility**: Both parties should be willing to compromise and find a solution that benefits all stakeholders involved.

In conclusion, the positioning of franchise royalty collateral liens in multi-unit financing arrangements is a critical aspect that requires careful consideration. By understanding its significance and following best practices, both franchisees and lenders can create a mutually beneficial agreement that supports the growth and success of the franchise network.