Introduction:

In the world of finance and accounting, lease agreements play a significant role in businesses. These agreements allow companies to use assets without purchasing them outright. Two key accounting standards, ASC 842 and operating lease treatment, govern how these leases are accounted for. This article aims to provide a comprehensive comparison between ASC 842 and operating lease treatment, highlighting their differences and implications for businesses.

ASC 842: A Brief Overview

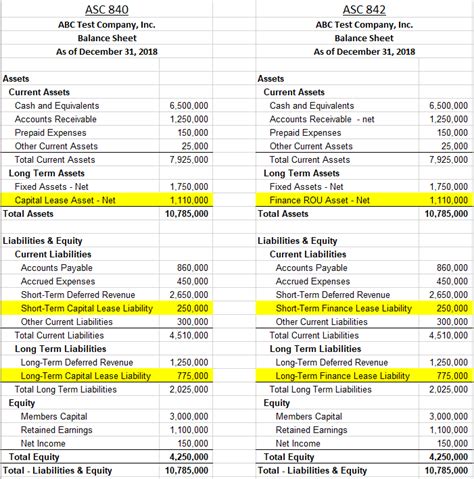

ASC 842, or Accounting Standards Codification 842, is a standard issued by the Financial Accounting Standards Board (FASB) in 2016. It provides guidelines for the accounting of leases by lessees. The primary objective of ASC 842 is to increase transparency and comparability in financial reporting by requiring lessees to recognize assets and liabilities for most leases on their balance sheets.

Key Aspects of ASC 842:

1. Recognition: Lessees must recognize a right-of-use asset and a lease liability on their balance sheets for all leases with a term of more than 12 months.

2. Measurement: The right-of-use asset is initially measured at the present value of lease payments, and the lease liability is measured at the present value of the remaining lease payments.

3. Disclosure: Lessees are required to provide additional disclosures regarding their leases, including the nature of the underlying assets, the classification of leases, and the terms and conditions of the agreements.

Operating Lease Treatment:

Operating lease treatment refers to the accounting treatment of leases that do not meet the criteria for recognition under ASC 842. Under this treatment, lessees recognize lease payments as operating expenses on their income statements.

Key Aspects of Operating Lease Treatment:

1. Recognition: Lessees do not recognize any assets or liabilities for operating leases on their balance sheets.

2. Measurement: Lease payments are recognized as operating expenses on the income statement over the lease term.

3. Disclosure: Lessees are required to provide certain disclosures regarding their operating leases, such as the total lease payments and the term of the lease.

Comparison between ASC 842 and Operating Lease Treatment:

1. Recognition:

– ASC 842: Lessees must recognize assets and liabilities for most leases on their balance sheets.

– Operating Lease Treatment: Lessees do not recognize any assets or liabilities for operating leases on their balance sheets.

2. Measurement:

– ASC 842: The right-of-use asset is measured at the present value of lease payments, and the lease liability is measured at the present value of the remaining lease payments.

– Operating Lease Treatment: Lease payments are recognized as operating expenses on the income statement over the lease term.

3. Disclosure:

– ASC 842: Lessees are required to provide additional disclosures regarding their leases, including the nature of the underlying assets, the classification of leases, and the terms and conditions of the agreements.

– Operating Lease Treatment: Lessees are required to provide certain disclosures regarding their operating leases, such as the total lease payments and the term of the lease.

Implications for Businesses:

1. Financial Reporting: ASC 842 requires lessees to recognize assets and liabilities for most leases, which may affect their financial ratios and reported earnings.

2. Cash Flow: Under ASC 842, lease payments are recognized as interest expense, which may affect a company’s cash flow compared to operating lease treatment.

3. Transparency: ASC 842 provides more transparency regarding a company’s lease obligations, allowing stakeholders to better understand their financial position.

Conclusion:

In conclusion, ASC 842 and operating lease treatment have distinct differences in how leases are accounted for. ASC 842 requires lessees to recognize assets and liabilities for most leases, while operating lease treatment treats lease payments as operating expenses. Businesses must be aware of these differences and their implications to ensure accurate financial reporting and compliance with accounting standards.