Introduction:

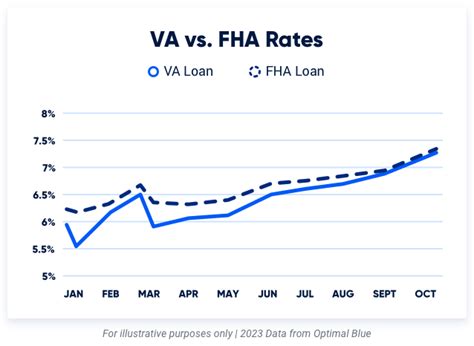

When it comes to securing a mortgage, there are several loan options available, each with its own set of benefits and requirements. Two popular choices are FHA (Federal Housing Administration) loans and VA (Veterans Affairs) loans. In this article, we will compare these two loan types, focusing on the 3.5% down payment option for FHA loans and the funding fee for VA loans. We will also delve into a break-even analysis to help you determine which loan might be the most suitable for your financial situation.

FHA Loans:

FHA loans are designed to make homeownership more accessible to individuals with lower credit scores and smaller down payments. These loans require a minimum down payment of 3.5% of the purchase price, making them an attractive option for many borrowers. However, it’s important to note that FHA loans come with mortgage insurance premiums (MIP) that can vary based on the loan-to-value (LTV) ratio and the borrower’s credit score.

VA Loans:

VA loans are exclusively available to eligible veterans, active-duty military personnel, and certain surviving spouses. These loans offer a unique advantage: no down payment is required. However, VA loans do come with a funding fee, which can vary depending on the borrower’s military service and whether it’s the first time they are using their VA loan benefit.

3.5% Down vs Funding Fee Break-Even Analysis:

To determine which loan option is more cost-effective, let’s conduct a break-even analysis comparing the 3.5% down payment for an FHA loan with the funding fee for a VA loan. We will consider the following factors:

1. Loan Amount: Assume a $200,000 loan amount for both scenarios.

2. Interest Rate: Assume a 3% interest rate for both loans.

3. Term: Assume a 30-year fixed-rate mortgage for both loans.

4. Property Value: Assume a property value of $250,000.

5. Closing Costs: Assume $5,000 in closing costs for both loans.

FHA Loan Breakdown:

– Down Payment: $7,000 (3.5% of $200,000)

– Monthly Mortgage Payment: $926.86 (including MIP)

– Total Interest Paid Over 30 Years: $328,795.20

– Total Closing Costs: $5,000

VA Loan Breakdown:

– Down Payment: $0

– Funding Fee: $4,500 (2.25% of $200,000)

– Monthly Mortgage Payment: $926.86

– Total Interest Paid Over 30 Years: $328,795.20

– Total Closing Costs: $5,000

Break-Even Analysis:

To determine the break-even point, we need to compare the total interest paid over 30 years for both loan types. In this scenario, the total interest paid for both loans is the same ($328,795.20). Therefore, the break-even point is reached after 30 years of mortgage payments.

Conclusion:

Based on this break-even analysis, both FHA and VA loans have similar long-term costs when considering the 3.5% down payment for an FHA loan and the funding fee for a VA loan. However, it’s important to note that the VA loan eliminates the need for a down payment, which can be a significant advantage for eligible borrowers. Ultimately, the decision between an FHA loan and a VA loan should be based on individual circumstances, including credit scores, income, and eligibility requirements. Consulting with a mortgage professional can provide personalized guidance to help you make the best choice for your situation.