Introduction:

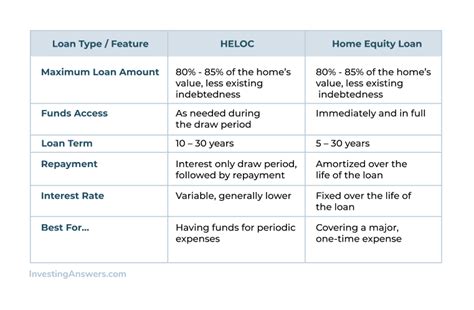

When it comes to home equity loans, borrowers often find themselves navigating a complex landscape of options and terms. One of the key decisions to make is whether to opt for a fixed-rate or variable-rate home equity line of credit (HELOC). This article aims to shed light on the potential traps associated with fixed vs. variable rate HELOC draw periods, helping you make an informed decision.

Fixed-Rate HELOC Draw Periods:

A fixed-rate HELOC offers borrowers the peace of mind that their interest rate will remain the same throughout the draw period, typically ranging from 5 to 10 years. Here are some potential traps to be aware of:

1. Higher Interest Rates: While fixed rates provide stability, they may be higher than variable rates, especially in a low-interest-rate environment. This could result in a higher overall cost of borrowing.

2. Limited Flexibility: If you anticipate changes in your financial situation, a fixed-rate HELOC may limit your ability to adjust your payment amounts or terms.

3. Prepayment Penalties: Some fixed-rate HELOCs may have prepayment penalties, which could penalize you for paying off the loan early.

Variable-Rate HELOC Draw Periods:

A variable-rate HELOC offers borrowers the opportunity to take advantage of lower initial interest rates, which can change over time. However, this comes with its own set of traps:

1. Rate Fluctuations: Variable rates can rise significantly, leading to higher monthly payments and potentially causing financial strain.

2. Uncertainty: With a variable-rate HELOC, you may not know exactly how much your interest rate will be until the draw period ends. This uncertainty can make budgeting and financial planning difficult.

3. HELOC Conversion: If you prefer the stability of a fixed rate, you may have to convert your variable-rate HELOC to a fixed-rate loan, which could involve additional fees and terms.

Conclusion:

When choosing between fixed vs. variable rate HELOC draw periods, it’s crucial to weigh the pros and cons of each option. Fixed-rate HELOCs offer stability but may come with higher interest rates and limited flexibility. Variable-rate HELOCs provide potential savings but come with the risk of rate fluctuations and uncertainty.

To avoid traps, consider the following tips:

1. Conduct thorough research and compare offers from multiple lenders.

2. Assess your financial situation and risk tolerance.

3. Understand the terms and conditions of the loan, including any prepayment penalties or conversion fees.

4. Consider consulting with a financial advisor to help you make an informed decision.

By taking the time to understand the potential traps associated with fixed vs. variable rate HELOC draw periods, you can make a well-informed choice that aligns with your financial goals and needs.