Introduction:

The United States Department of Agriculture (USDA) offers various loan programs to support rural communities and individuals in need of financial assistance. Two key factors that determine eligibility for these loans are rural area mapping and income limit adjustments. This article will explore the differences between these two aspects and their impact on USDA loan eligibility.

Rural Area Mapping:

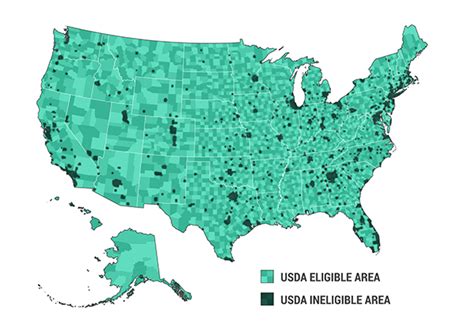

Rural area mapping is a crucial component of determining eligibility for USDA loans. The USDA defines rural areas as places with a population of 10,000 or less, or areas that are not within a metropolitan statistical area (MSA). The mapping process involves identifying eligible rural areas based on geographic data and population statistics.

The USDA uses a combination of geographic information systems (GIS) and demographic data to create a comprehensive rural area map. This map helps lenders and borrowers identify eligible locations for USDA loans. By understanding the rural area mapping process, individuals can determine if their property or the area they wish to purchase is eligible for USDA loan benefits.

Income Limit Adjustments:

Income limit adjustments are another critical factor in determining eligibility for USDA loans. The USDA sets income limits based on household size and the median income of the area. These limits ensure that the loans are accessible to low- and moderate-income individuals and families.

Income limit adjustments are subject to change annually, reflecting the evolving economic conditions in different regions. The adjustments are designed to ensure that the loans remain affordable and accessible to eligible borrowers. To qualify for a USDA loan, borrowers must meet the income limits set by the USDA for their specific area.

Comparison of Rural Area Mapping and Income Limit Adjustments:

1. Purpose:

Rural area mapping is focused on identifying eligible locations for USDA loans, while income limit adjustments are aimed at ensuring that the loans are accessible to low- and moderate-income individuals and families.

2. Methodology:

Rural area mapping relies on GIS and demographic data to create a comprehensive map of eligible rural areas. Income limit adjustments are based on median income statistics and household size.

3. Impact on Eligibility:

Both rural area mapping and income limit adjustments play a significant role in determining eligibility for USDA loans. A property’s location must be within an eligible rural area, and the borrower’s income must meet the income limit requirements.

4. Flexibility:

Rural area mapping is a static process, as the map remains constant until updated. Income limit adjustments, on the other hand, are subject to change annually, reflecting the evolving economic conditions in different regions.

Conclusion:

Understanding the rural area mapping and income limit adjustments is essential for individuals seeking USDA loans. By familiarizing themselves with these factors, borrowers can determine their eligibility and take advantage of the financial benefits offered by the USDA. As the USDA continues to support rural communities, both rural area mapping and income limit adjustments will remain key components in ensuring that these loans remain accessible and beneficial for eligible borrowers.