Introduction:

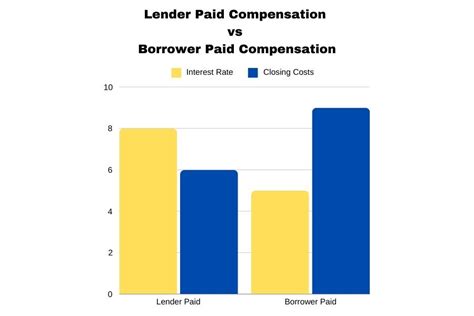

In the mortgage industry, loan officers play a pivotal role in facilitating loans for borrowers. As such, their compensation is a critical aspect of the business model. One significant area of contention is the difference between lender-paid and borrower-paid yield spreads. This article delves into the nuances of these two compensation structures, highlighting their benefits and potential drawbacks.

Lender-Paid Yield Spreads:

Lender-Paid Yield Spreads (LPYS) are a form of compensation where the lender pays the loan officer a fee based on the yield spread. This fee is typically a percentage of the difference between the interest rate offered to the borrower and the cost of funds for the lender. The following are some key points regarding LPYS:

1. Cost Efficiency: Lender-paid compensation can be more cost-effective for lenders, as it provides an incentive for loan officers to close more loans at a lower interest rate, potentially reducing the overall cost of funds.

2. Incentive for Sales: LPYS can encourage loan officers to sell more loans, as they receive additional compensation for closing deals. This can lead to increased revenue for the lender.

3. Potential Conflicts of Interest: Some critics argue that LPYS may create conflicts of interest, as loan officers may prioritize closing loans with higher yield spreads, even if it means offering borrowers less favorable terms.

Borrower-Paid Yield Spreads:

Borrower-Paid Yield Spreads (BPYS) are a form of compensation where the borrower pays the loan officer a fee based on the yield spread. This fee is usually included in the loan’s interest rate. The following are some key points regarding BPYS:

1. Transparency: BPYS provide greater transparency for borrowers, as the yield spread is directly reflected in the interest rate. This allows borrowers to easily compare loan offers.

2. No Conflicts of Interest: BPYS eliminate the potential conflicts of interest associated with LPYS, as loan officers are not incentivized to sell loans with higher yield spreads.

3. Higher Borrower Costs: Borrowers may face higher costs with BPYS, as the yield spread is included in the interest rate. This can make loans more expensive compared to those with LPYS.

Conclusion:

Both lender-paid and borrower-paid yield spreads have their own advantages and disadvantages. Lender-paid compensation can be more cost-effective for lenders and encourage loan officers to close more loans, but it may create conflicts of interest. Borrower-paid compensation offers transparency and eliminates potential conflicts of interest, but can lead to higher borrower costs.

Ultimately, the choice between LPYS and BPYS depends on the specific goals and values of the lender and borrower. It is essential to carefully consider the implications of each compensation structure to ensure the best outcome for all parties involved.