In the wake of the economic turmoil caused by the COVID-19 pandemic, many auto loan borrowers have found themselves struggling to meet their monthly payments. As a result, numerous financial institutions have offered deferred payment options, including the 90-day forbearance, to ease the financial strain. However, these auto payment deferral programs come with hidden traps that borrowers must be aware of. One of the most significant concerns is the 90-day forbearance interest capitalization.

The 90-Day Forbearance

The 90-day forbearance is a temporary measure designed to give borrowers some breathing room. During this period, borrowers can either defer their payments or make partial payments without facing immediate consequences. While this may seem like a much-needed reprieve, the reality is that these deferred payments will catch up with the borrower later on.

Interest Capitalization: The Hidden Trap

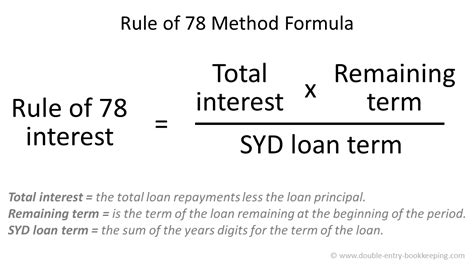

Interest capitalization is a term that refers to adding the interest that accumulates on an auto loan to the principal balance. When you defer your payments during the 90-day forbearance period, the interest continues to accrue on your loan. However, instead of being charged at the end of the forbearance, the interest is added to the principal amount. This means that the total amount you owe will increase, potentially leading to a higher monthly payment in the long run.

The consequences of interest capitalization can be severe:

1. Increased Total Cost of Ownership: As the principal amount grows due to capitalized interest, the total cost of owning the vehicle will also increase. This could make the car more expensive than initially anticipated.

2. Extended Loan Term: To manage the higher principal balance, borrowers may find themselves in a longer loan term, which means paying interest for a more extended period.

3. Potential for Default: With a higher principal balance and a longer loan term, borrowers may find it challenging to keep up with their monthly payments, potentially leading to default and repossession.

4. Negative Impact on Credit Score: Deferring payments and capitalizing interest can negatively affect your credit score, which could impact your ability to secure future credit.

Tips for Borrowers

To avoid falling into the traps associated with auto payment deferral, here are some tips for borrowers:

1. Communicate with Your Lender: Before agreeing to a payment deferral, discuss the terms and conditions with your lender, including interest capitalization.

2. Consider Alternative Solutions: Explore other options, such as refinancing or negotiating a more manageable payment plan with your lender.

3. Plan Your Budget: If you decide to defer your payments, ensure that you can afford the increased monthly payment when the forbearance period ends.

4. Monitor Your Credit Score: Regularly check your credit score to track the impact of deferring payments and capitalizing interest.

By understanding the potential pitfalls of auto payment deferral and taking the necessary precautions, borrowers can navigate these challenging times without falling into the trap of interest capitalization.