Introduction:

When it comes to renting a car, whether for personal or commercial purposes, the complexities can often be overwhelming. One of the most critical aspects to consider is insurance. Understanding the differences between commercial and personal use insurance is essential in making an informed decision. This article will delve into the complexities of rental car loans and highlight the key differences between commercial and personal use insurance.

I. Understanding Rental Car Loans

1. Loan Structure:

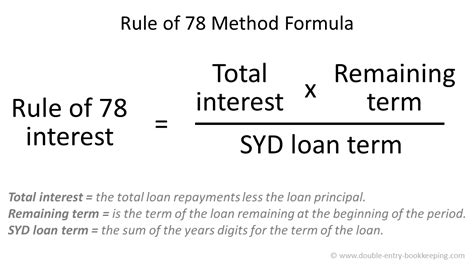

Rental car loans are designed to cover the cost of renting a vehicle for a specific period. The loan structure typically involves an upfront payment followed by monthly installments until the loan is fully repaid.

2. Interest Rates:

Interest rates on rental car loans can vary depending on factors such as the duration of the rental, the car’s make and model, and the borrower’s credit history.

3. Collateral:

In most cases, rental car loans do not require collateral. However, if the borrower has a poor credit history, the lender may require a security deposit.

II. Commercial vs. Personal Use Insurance

1. Personal Use Insurance:

Personal use insurance is designed for individuals renting a car for personal reasons, such as a vacation or a day out. This type of insurance covers damages and accidents that occur during the rental period, as long as the vehicle is used for personal purposes.

Key Points:

– Personal use insurance is generally more affordable than commercial use insurance.

– Personal use insurance may exclude coverage for certain high-risk activities, such as off-road driving or transporting hazardous materials.

2. Commercial Use Insurance:

Commercial use insurance is tailored for businesses that require vehicles for their operations. This type of insurance covers damages and accidents that occur during the rental period, regardless of the vehicle’s usage.

Key Points:

– Commercial use insurance is generally more expensive than personal use insurance due to the higher risk involved.

– Commercial use insurance may provide additional coverage, such as liability protection and protection for the rented vehicle’s contents.

III. Considerations for Borrowers

1. Usage Intent:

When applying for a rental car loan, borrowers must specify whether the vehicle will be used for personal or commercial purposes. This determination will impact the type of insurance required and the loan terms.

2. Cost Analysis:

Borrowers should conduct a cost analysis to determine whether the additional cost of commercial use insurance is justified, especially if the vehicle will be used for business purposes.

3. Liability Concerns:

Commercial use insurance may provide more comprehensive liability protection, which can be crucial for businesses operating in high-risk industries.

Conclusion:

Navigating the complexities of rental car loans and insurance can be challenging. However, understanding the differences between commercial and personal use insurance is crucial in making an informed decision. By considering the intended usage, conducting a cost analysis, and assessing liability concerns, borrowers can ensure they choose the appropriate insurance coverage for their rental car needs.