Title insurance is a crucial aspect of the real estate transaction process, providing buyers and lenders with the peace of mind that the property title is clear of any liens, encumbrances, or other issues. One important consideration when purchasing title insurance is the coverage amount, which can vary significantly between salvage title insurance with 50% value coverage and total loss payouts. This article aims to explore the differences between these two types of coverage and help you make an informed decision for your real estate investment.

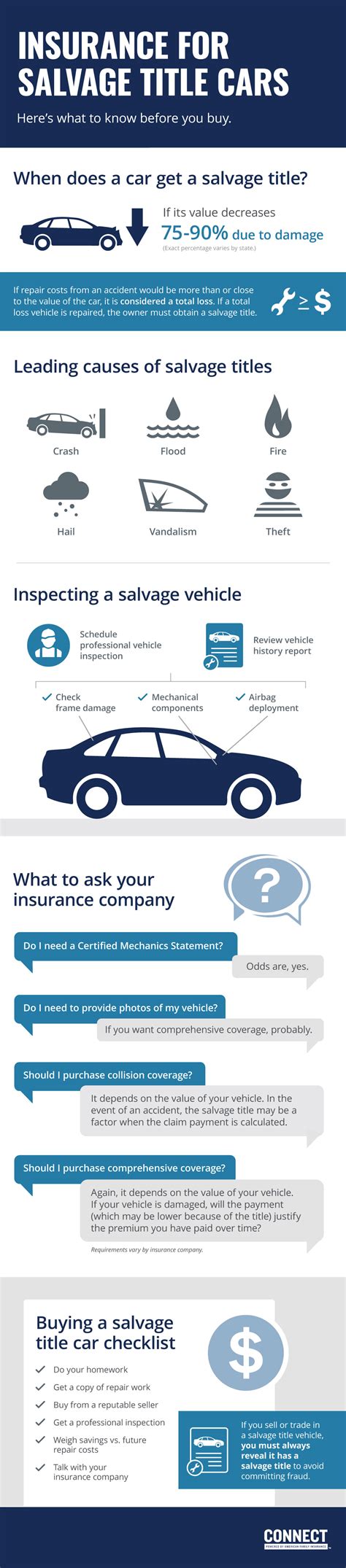

**Salvage Title Insurance: 50% Value Coverage**

Salvage title insurance with 50% value coverage is a type of policy that provides limited protection for the property’s title. In the event that a covered claim arises, the insurance company will pay up to 50% of the property’s value at the time of the claim. This type of coverage is typically less expensive than a full-value policy but offers less comprehensive protection.

**Pros of 50% Value Coverage:**

1. Cost-Effective: Salvage title insurance is more affordable than a policy with full-value coverage, making it a budget-friendly option for buyers or lenders.

2. Simplicity: The coverage is straightforward, providing a clear understanding of the protection offered.

**Cons of 50% Value Coverage:**

1. Limited Protection: The coverage amount is significantly lower than full-value coverage, which may not be sufficient to cover the cost of resolving title issues.

2. Financial Risk: If the title issue is significant, the buyer or lender may be responsible for the remaining 50% of the cost to rectify the problem.

**Total Loss Payouts**

Total loss payouts are a type of title insurance coverage that provides full protection for the property’s title. In the event that a covered claim arises, the insurance company will pay the full value of the property, up to the policy limits. This type of coverage is more expensive than a 50% value policy but offers comprehensive protection.

**Pros of Total Loss Payouts:**

1. Comprehensive Protection: Total loss payouts cover the full value of the property, reducing the financial risk associated with title issues.

2. Peace of Mind: Knowing that the entire cost of a title issue will be covered provides peace of mind for buyers and lenders.

**Cons of Total Loss Payouts:**

1. Higher Cost: Total loss payouts are more expensive than 50% value coverage, which may not be suitable for budget-conscious buyers or lenders.

2. Complex Policy: The coverage details may be more complicated, requiring a thorough understanding of the policy terms.

**Conclusion**

When choosing between salvage title insurance with 50% value coverage and total loss payouts, it’s essential to consider your financial situation, the value of the property, and the level of protection you require. While 50% value coverage is more affordable, it may not provide sufficient protection for significant title issues. On the other hand, total loss payouts offer comprehensive protection but come at a higher cost.

Ultimately, the best option depends on your individual needs and priorities. It is advisable to consult with a real estate attorney or title insurance professional to determine the most suitable coverage for your real estate investment.