Introduction:

Student loan debt has become a significant burden for millions of Americans, with many struggling to make their monthly payments. For those facing insurmountable debt, bankruptcy may seem like a viable solution. However, the process of discharging student loans through bankruptcy is not straightforward, as it involves meeting certain criteria. This article compares the traditional Brunner Test with the new undue hardship standards in student loan bankruptcy cases.

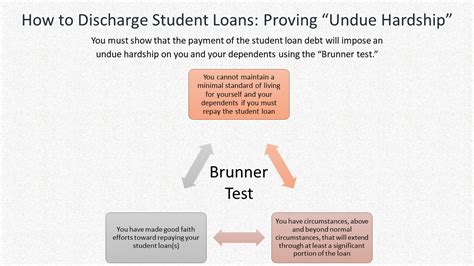

The Brunner Test:

The Brunner Test is a three-part test used by bankruptcy courts to determine whether a borrower is eligible for the discharge of their student loan debt. The test was established in 1987 and has been the primary standard for evaluating undue hardship since then. To pass the Brunner Test, a borrower must demonstrate the following:

1. The borrower cannot maintain a minimal standard of living for themselves and their dependents if forced to repay the student loans.

2. The borrower has made good faith efforts to repay the student loans.

3. There is a demonstrated likelihood that the borrower’s circumstances will persist for a significant portion of the repayment period.

The Brunner Test has been widely used and has helped many borrowers discharge their student loans. However, the test has faced criticism for being too stringent and difficult to meet, especially for those with lower incomes.

New Undue Hardship Standards:

In response to the challenges faced by borrowers under the Brunner Test, the Department of Education proposed new undue hardship standards in 2016. These new standards were designed to make it easier for borrowers to discharge their student loans in bankruptcy. The key changes include:

1. A more flexible approach to evaluating the borrower’s income and expenses.

2. A focus on the borrower’s overall financial situation, rather than just their income.

3. A requirement that the borrower demonstrate a reasonable expectation of being able to repay the loans in the future.

Comparison:

When comparing the Brunner Test with the new undue hardship standards, several key differences become apparent:

1. Flexibility: The new standards are more flexible, making it easier for borrowers to demonstrate undue hardship. This is particularly beneficial for those with lower incomes or significant financial obligations.

2. Evaluation Criteria: The new standards take into account the borrower’s overall financial situation, rather than focusing solely on their income. This can help those with non-traditional income sources or high living expenses.

3. Repayment Expectations: The new standards require a reasonable expectation of future repayment, which may be more attainable for some borrowers than the strict “likelihood” requirement of the Brunner Test.

Conclusion:

The introduction of new undue hardship standards in student loan bankruptcy cases represents a significant shift in how courts evaluate the discharge of student loan debt. While the Brunner Test has been the primary standard for many years, the new standards offer a more flexible and comprehensive approach to determining undue hardship. As the landscape of student loan debt continues to evolve, these new standards may provide more relief to borrowers struggling to make their monthly payments. However, it is important to note that the discharge of student loan debt through bankruptcy remains a complex and challenging process, and borrowers should seek legal counsel when considering this option.