Introduction:

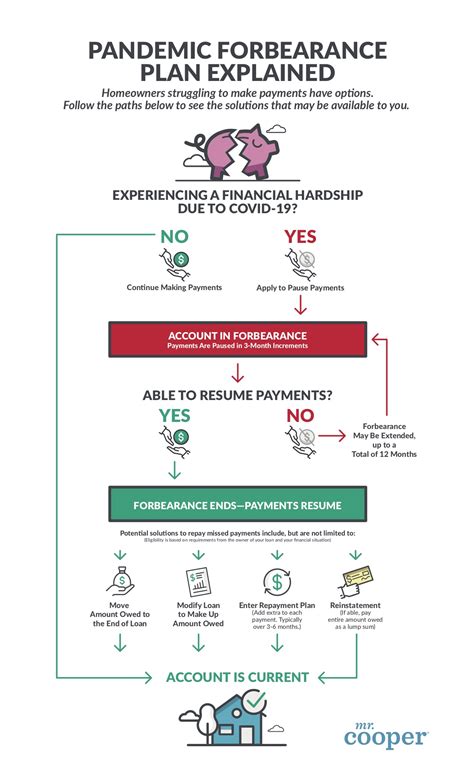

The COVID-19 pandemic has brought about unprecedented challenges for homeowners, with many struggling to keep up with their mortgage payments. In response, the government and financial institutions have implemented various relief programs to assist borrowers. However, this has also created an opportunity for scammers to exploit unsuspecting homeowners through forbearance steering scams. This article aims to shed light on these scams and compare the capitalized interest option with the Income-Driven Repayment (IDR) plan options available to borrowers.

Forbearance Steering Scams:

Forbearance steering scams occur when fraudulent entities or individuals deceive homeowners into choosing a forbearance option that benefits the scammer rather than the borrower. These scammers may promise to negotiate with lenders on behalf of the borrower, offering to secure a favorable forbearance agreement in exchange for an upfront fee. However, once the fee is paid, the scammer disappears, leaving the borrower in a worse financial situation.

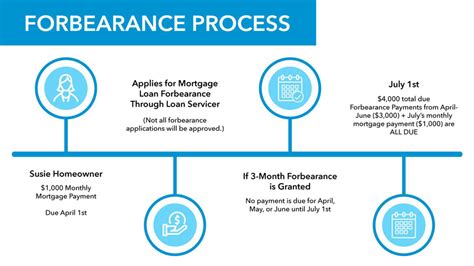

Capitalized Interest:

One of the most common options that scammers push is the capitalized interest. This option allows borrowers to temporarily pause their mortgage payments, with the interest accumulating and added to the principal balance of the loan. While this may seem appealing for those struggling to pay, it can lead to long-term financial consequences.

Advantages:

– Provides temporary relief from monthly mortgage payments.

– Allows borrowers to catch up on their mortgage if they fall behind.

Disadvantages:

– Interest accumulates, increasing the overall debt.

– Higher monthly payments in the future due to the increased principal balance.

– Can negatively impact the borrower’s credit score.

Income-Driven Repayment (IDR) Plan Options:

In contrast to the capitalized interest option, IDR plans are designed to help borrowers manage their student loan debt by adjusting their monthly payments based on their income. There are several IDR plans available, each with its own set of benefits and requirements.

1. Standard Repayment Plan:

– Monthly payments are fixed for up to 10 years.

– Payments are based on the total amount of the loan and the interest rate.

2. Graduated Repayment Plan:

– Monthly payments start low and increase gradually every two years.

– Ideal for borrowers who expect their income to increase over time.

3. Extended Repayment Plan:

– Monthly payments are fixed for up to 25 years.

– Suitable for borrowers with high loan balances and low income.

4. Income-Contingent Repayment (ICR) Plan:

– Monthly payments are based on the borrower’s income, family size, and the amount of the loan.

– Payments cannot exceed 20% of the borrower’s discretionary income.

5. Pay As You Earn (PAYE) Plan:

– Monthly payments are based on the borrower’s income, family size, and the amount of the loan.

– Payments cannot exceed 10% of the borrower’s discretionary income.

Conclusion:

Forbearance steering scams can have severe consequences for homeowners struggling to keep up with their mortgage payments. Borrowers should be cautious and research their options thoroughly before making any decisions. While capitalized interest may provide short-term relief, it is important to understand the long-term financial implications. Exploring IDR plan options can offer more sustainable solutions for managing student loan debt. By being informed and aware, borrowers can avoid falling victim to scams and make the best choices for their financial future.