Introduction:

Married couples often find themselves at a crossroads when it comes to tax filing. One of the options available is married filing separately. This method can have significant implications for your tax situation, especially when it comes to the Installment Agreement Repayment (IDR) plan and potential tax penalties. In this article, we will delve into the mathematics behind these scenarios to help you make an informed decision.

Understanding Married Filing Separately:

Married filing separately is a tax filing status that allows married couples to file their tax returns separately. This status can be beneficial in certain situations, such as when one spouse has substantial medical expenses or when one spouse wants to keep their tax liabilities separate from their partner.

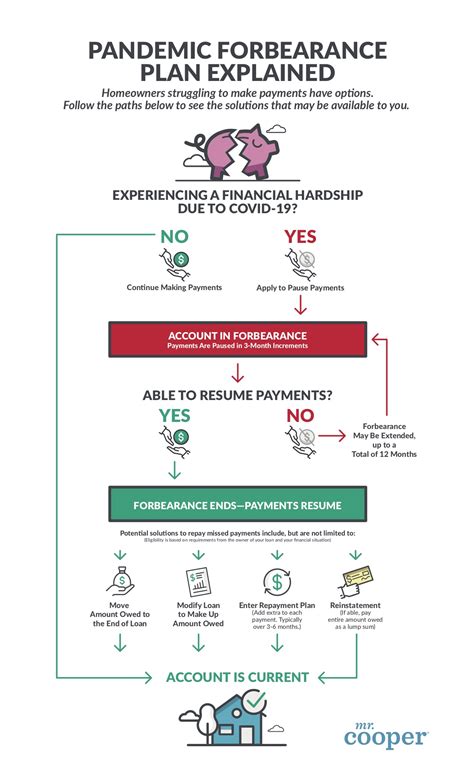

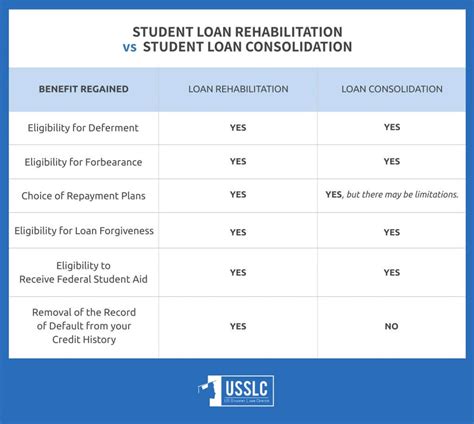

Installment Agreement Repayment (IDR) Plan:

If you owe taxes and are unable to pay the full amount immediately, the IRS offers an Installment Agreement Repayment (IDR) plan. This plan allows you to pay your tax debt in manageable monthly installments over a specified period.

Comparing Math IDR Plan Savings vs Tax Penalties:

1. Lower Tax Liabilities:

When married couples file separately, their tax liabilities are typically lower compared to filing jointly. This is because the standard deduction for married filing separately is higher than the standard deduction for married filing jointly. As a result, married couples who file separately may have lower tax liabilities, which could lead to savings in the long run.

2. Reduced Penalties:

Filing married filing separately can also help reduce potential tax penalties. Penalties such as failure to file, failure to pay, and underpayment penalties are generally lower for married filing separately than for married filing jointly. This can result in significant savings, especially if you are unable to pay your full tax liability.

3. IDR Plan Savings:

When you enter into an IDR plan, the IRS may offer you a lower monthly payment amount. This is particularly beneficial for married couples filing separately, as they may have lower overall tax liabilities, leading to reduced monthly IDR payments.

4. Potential for Penalty Abatement:

Married couples who file separately may be eligible for penalty abatement if they can demonstrate that they were unable to pay their taxes due to reasonable cause. This can be an added advantage when comparing the savings from the IDR plan to the potential tax penalties.

Conclusion:

While married filing separately can offer certain benefits, such as lower tax liabilities and reduced penalties, it is essential to weigh these advantages against the potential drawbacks. Consider your individual circumstances, including your tax liabilities, financial situation, and eligibility for penalty abatement before deciding on the best filing status for you. Consulting with a tax professional can provide further insight into the mathematics behind married filing separately, IDR plan savings, and tax penalties.