Title: Student Loan Rehab Scams: The Dangers of Third-Party Default Resolution Fees

Introduction:

Student loans have become an integral part of higher education in the United States. However, the overwhelming debt burden can lead to defaults and the need for loan rehabilitation. In recent years, numerous scams have emerged targeting students struggling with loan defaults. One of the most common scams involves third-party default resolution fees. This article aims to shed light on the dangers of these fees and how students can protect themselves from falling victim to such fraudulent schemes.

The Rise of Student Loan Rehabilitation Scams:

The demand for loan rehabilitation has skyrocketed as the number of student loan defaults continues to rise. Scammers have taken advantage of this situation by offering seemingly legitimate services to help students navigate the rehabilitation process. One such scam involves charging exorbitant fees for third-party default resolution services.

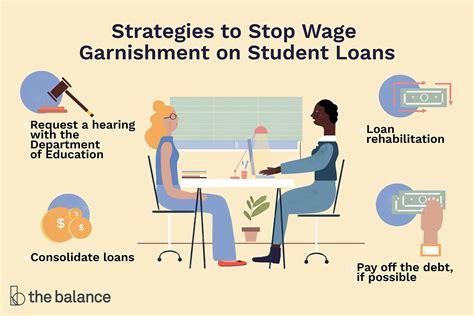

Understanding Third-Party Default Resolution Fees:

Third-party default resolution fees are charges imposed by entities other than the federal government or the loan servicer. These companies claim to provide assistance in negotiating lower monthly payments, removing late payments from credit reports, and navigating the rehabilitation process. However, many of these companies are nothing more than scams designed to exploit vulnerable students.

The Dangers of Third-Party Default Resolution Fees:

1. Exorbitant Fees: Scammers often charge high fees for their services, which can be several times the actual cost of rehabilitation. This can further burden students who are already struggling with debt.

2. Misleading Information: Scammers may provide false or misleading information about the loan rehabilitation process, leading students to believe that they are receiving genuine assistance.

3. Unauthorized Access to Personal Information: Scammers may require students to provide sensitive personal information, such as social security numbers and bank account details, which can be used for identity theft or other fraudulent activities.

4. Ineffectiveness: In many cases, third-party default resolution companies fail to deliver on their promises, leaving students in a worse financial situation than before.

Protecting Yourself from Scams:

To protect yourself from falling victim to student loan rehab scams, follow these tips:

1. Verify the Company: Ensure that the company you are dealing with is legitimate and has a good reputation. Check for any complaints or negative reviews online.

2. Be Wary of High Fees: Be cautious of companies charging exorbitant fees for their services. Remember, legitimate assistance should be available for free or at a minimal cost.

3. Contact Your Loan Servicer: Before hiring a third-party company, consult with your loan servicer directly. They can provide guidance and assistance in navigating the rehabilitation process.

4. Educate Yourself: Familiarize yourself with the loan rehabilitation process and understand your rights as a borrower. This will help you identify potential scams.

Conclusion:

Student loan rehab scams, particularly those involving third-party default resolution fees, pose a significant threat to students struggling with loan defaults. By staying informed and taking proactive measures to protect yourself, you can avoid falling victim to these fraudulent schemes and secure a brighter financial future.