Introduction:

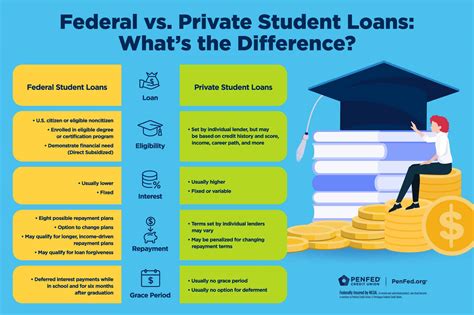

Student loan refinancing has become an increasingly popular option for borrowers looking to reduce their monthly payments and save money over the life of their loans. With various interest rates available, it’s crucial to understand the break-even point when considering refinancing. In this article, we’ll delve into the math behind refinancing federal loans with a 5% interest rate versus refinancing private loans with a 3% interest rate and determine the break-even point.

Understanding the Break-Even Point:

The break-even point is the time it takes for the savings from refinancing to outweigh the costs associated with refinancing. These costs include any fees or penalties incurred during the refinancing process. To calculate the break-even point, we need to consider the following factors:

1. Original loan balance

2. Original interest rate

3. New interest rate

4. Refinancing fees or penalties

5. Monthly payment difference

Assumptions:

For the purpose of this article, let’s assume the following:

– Original loan balance: $50,000

– Original interest rate (federal): 5%

– New interest rate (private): 3%

– Refinancing fees: $1,000

– Monthly payment difference: $100

Calculating the Break-Even Point:

To calculate the break-even point, we need to determine how many months it will take for the monthly savings to accumulate and cover the refinancing fees.

1. Calculate the monthly savings:

Monthly savings = Original monthly payment – New monthly payment

Original monthly payment = Original loan balance * Original interest rate / 12

New monthly payment = Original loan balance * New interest rate / 12

Original monthly payment = $50,000 * 0.05 / 12 = $208.33

New monthly payment = $50,000 * 0.03 / 12 = $125

Monthly savings = $208.33 – $125 = $83.33

2. Calculate the break-even point:

Break-even point = Refinancing fees / Monthly savings

Break-even point = $1,000 / $83.33 ≈ 12 months

Conclusion:

Based on our assumptions, refinancing a federal loan with a 5% interest rate to a private loan with a 3% interest rate will take approximately 12 months to break even. This means that after 12 months, the borrower will start saving money on their monthly payments, and the savings will continue to accumulate over the life of the loan. However, it’s essential to consider other factors, such as credit score, loan term, and potential changes in interest rates before making a refinancing decision.