Introduction:

Loan forgiveness has been a beacon of hope for many individuals and families struggling with overwhelming debt. However, the tax implications of loan forgiveness have raised concerns among borrowers. This article aims to shed light on the 20% federal vs state tax liability maps, helping you understand the potential financial impact of loan forgiveness on your tax obligations.

Section 1: Understanding Loan Forgiveness

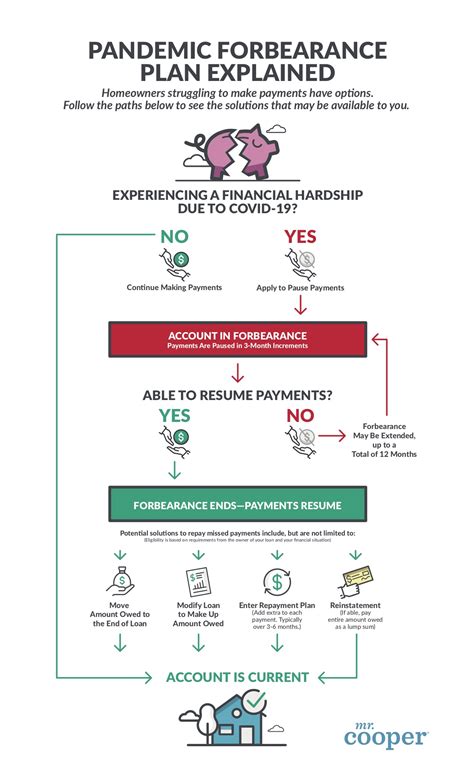

Loan forgiveness refers to the cancellation of a debt that a borrower is obligated to pay. This can occur in various scenarios, such as mortgage, student loan, or credit card debt forgiveness. While loan forgiveness can be a relief, it often comes with a significant tax burden.

Section 2: Federal Tax Implications

The IRS considers loan forgiveness as taxable income, which means that borrowers must report it on their tax returns. Under the Tax Cuts and Jobs Act (TCJA), the cancellation of debt (COD) income is subject to federal income tax. For federal tax purposes, borrowers may be liable for a 20% tax on the forgiven debt amount.

Section 3: State Tax Implications

While the federal tax implications of loan forgiveness are relatively straightforward, state tax laws can vary significantly. Some states may impose a similar tax on forgiven debt, while others may exempt it from taxation. This creates a complex landscape of state tax liability maps.

Section 4: 20% Federal vs State Tax Liability Maps

To help borrowers navigate the potential tax burden of loan forgiveness, we have compiled a comprehensive map that compares the federal and state tax liability for various types of debt forgiveness. This map takes into account the following factors:

– Debt forgiveness amount

– Type of debt (e.g., mortgage, student loan, credit card)

– State-specific tax laws

The map reveals that while the federal tax rate is consistent at 20% for all types of debt forgiveness, state tax rates can vary widely. Some states may impose a lower tax rate, while others may have no tax on forgiven debt at all.

Section 5: Planning for Tax Liability

Given the potential tax implications of loan forgiveness, it is crucial for borrowers to plan ahead. Here are some tips to help manage your tax liability:

– Consult with a tax professional to understand the specific tax implications of your loan forgiveness.

– Consider the impact of loan forgiveness on your overall tax situation, including your adjusted gross income (AGI) and potential tax brackets.

– Explore tax-saving strategies, such as adjusting your withholding or contributing to a retirement account.

– Keep detailed records of any loan forgiveness agreements and communicate with your lender to ensure accurate reporting.

Conclusion:

Loan forgiveness can be a valuable tool for managing debt, but it is essential to understand the potential tax implications. By familiarizing yourself with the 20% federal vs state tax liability maps and planning accordingly, you can minimize the financial impact of loan forgiveness on your tax obligations. Always consult with a tax professional for personalized advice tailored to your specific situation.