Introduction:

Loan discharge appeals are a crucial process for individuals who have been diagnosed with total and permanent disability (TPD). This article aims to provide an overview of the documentation required for loan discharge appeals, highlighting the importance of accurate and comprehensive evidence to support the claim.

1. Understanding Total and Permanent Disability (TPD):

Total and permanent disability refers to a condition where an individual is unable to work in any capacity due to a physical or mental impairment. This condition is typically certified by a medical professional and is recognized by financial institutions for loan discharge purposes.

2. Importance of Documentation:

Accurate and comprehensive documentation is essential for a successful loan discharge appeal. The following are key types of documentation that may be required:

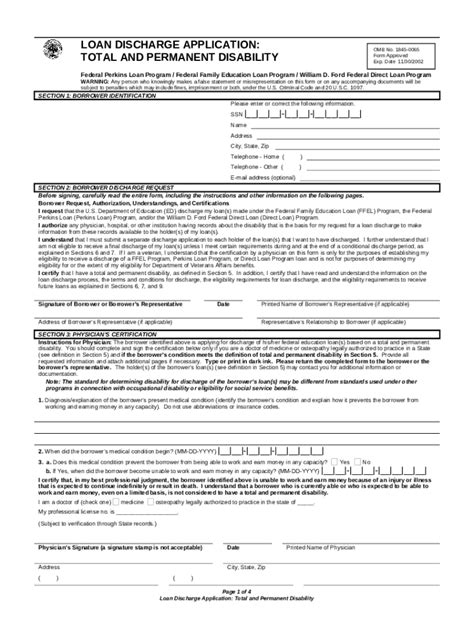

a. Medical Certification:

A detailed medical report from a qualified healthcare professional, confirming the diagnosis of total and permanent disability. This report should include the nature of the disability, its impact on the individual’s ability to work, and the expected duration of the disability.

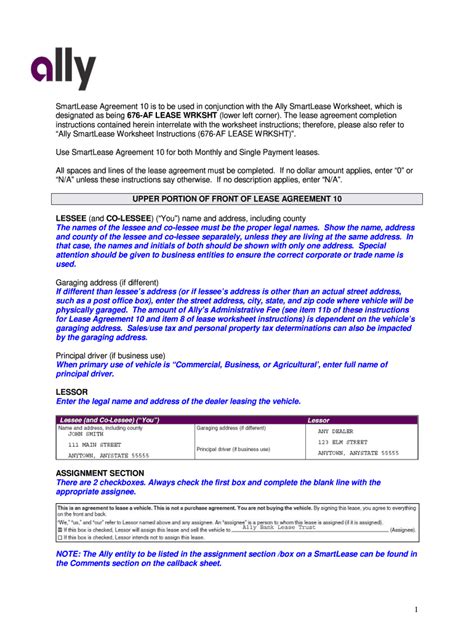

b. Employment Verification:

Proof of employment, such as pay stubs, tax returns, or employment contracts, demonstrating the individual’s previous employment status. This evidence helps establish the context in which the loan was obtained and the impact of the disability on their ability to repay the loan.

c. Income Verification:

Documentation of the individual’s current income, if any, to demonstrate their financial situation post-disability. This may include Social Security disability benefits, worker’s compensation, or any other forms of income support.

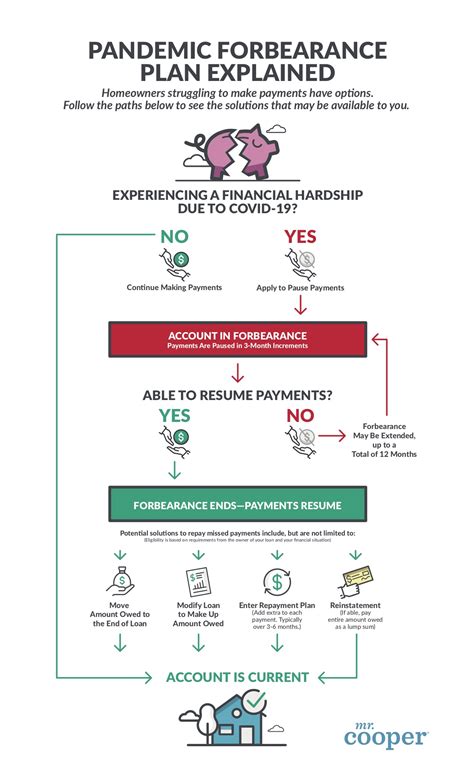

d. Correspondence with Financial Institution:

Copies of all communications between the individual and the financial institution regarding the loan discharge appeal. This includes letters, emails, or any other forms of correspondence that outline the individual’s request for loan discharge and the institution’s response.

3. Gathering Documentation:

To gather the necessary documentation for a loan discharge appeal, the following steps can be taken:

a. Consult with Healthcare Professionals:

Ensure that you have a detailed medical report from a qualified healthcare professional that supports the diagnosis of total and permanent disability.

b. Collect Employment and Income Evidence:

Gather all relevant employment and income documentation to demonstrate the individual’s financial situation before and after the diagnosis of disability.

c. Communicate with Financial Institution:

Maintain open communication with the financial institution throughout the loan discharge appeal process. Provide any additional documentation requested by the institution promptly.

4. Submitting the Appeal:

Once all the necessary documentation is gathered, submit the loan discharge appeal to the financial institution. Ensure that the appeal is complete, well-organized, and includes all required supporting documents.

Conclusion:

Loan discharge appeals for total and permanent disability require thorough documentation to support the claim. By understanding the importance of accurate and comprehensive evidence, individuals can increase their chances of a successful appeal. It is crucial to gather all necessary documentation, communicate effectively with the financial institution, and present a compelling case for loan discharge.