In the United States, student loans have become an integral part of the higher education landscape. For many, these loans provide the necessary financial support to pursue their academic and professional goals. However, the repayment of student loans can be a daunting task for many graduates, often leading to financial strain and potential credit impact. One significant aspect of student loan repayment is the reporting of delinquencies and deferments, which can significantly affect an individual’s credit score. This article delves into the difference between a 90-day delinquency and a deferment, and their respective impacts on credit.

**Understanding 90-Day Delinquency**

A 90-day delinquency occurs when a borrower fails to make a payment on their student loan within 90 days of the due date. This can happen for various reasons, such as financial hardship, job loss, or simply oversight. Once a borrower falls behind on payments, their credit report will reflect this as a delinquency.

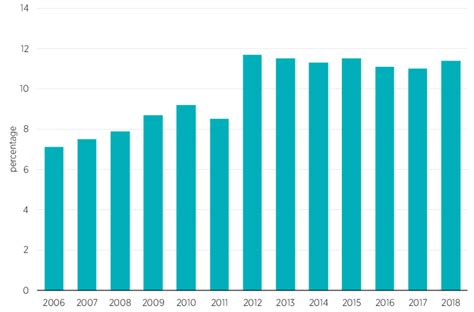

The impact of a 90-day delinquency on credit can be severe. According to credit scoring models, late payments are one of the most significant factors affecting credit scores. A 90-day delinquency can cause a borrower’s credit score to drop by as much as 100 points or more. This can make it more challenging for the borrower to obtain credit in the future, whether it’s for a car loan, mortgage, or even a credit card.

**The Role of Deferment**

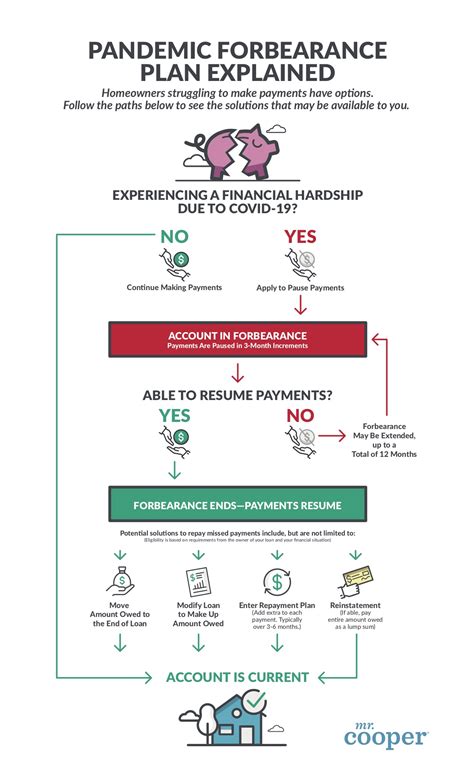

On the other hand, a deferment is a temporary suspension of loan payments. There are various types of deferments, such as economic hardship deferments, deferments for active military service, and deferments for graduate or professional studies. When a borrower enters a deferment, their loan payments are paused, and interest may continue to accrue, depending on the type of loan.

Reporting deferments on a credit report is less harmful than reporting a delinquency. While deferments are still reflected on the credit report, they do not typically have a negative impact on the borrower’s credit score. In fact, some lenders may view a deferment as a positive factor, as it demonstrates the borrower’s commitment to managing their debt responsibly.

**The Difference in Credit Impact**

The key difference between a 90-day delinquency and a deferment is the negative impact on credit. A delinquency can significantly damage a borrower’s credit score, whereas a deferment is generally reported without any adverse effects. It’s important to note that both delinquencies and deferments will remain on a credit report for seven years from the date of the late payment.

**Conclusion**

Student loan debt can be a significant financial burden, but understanding the reporting of delinquencies and deferments is crucial in managing one’s credit. Borrowers should make every effort to avoid falling into a 90-day delinquency by staying on top of their payments and seeking assistance if they encounter financial difficulties. By understanding the credit impact of these situations, graduates can better navigate their student loan debt and maintain a healthy credit score for the future.