Introduction:

When it comes to obtaining an emergency loan, individuals often have various options to choose from. Two popular choices are collateral pawnshops and title loans. Both offer quick access to funds, but they differ in terms of collateral, loan-to-value (LTV) ratios, and the overall borrowing process. This article will compare emergency loan collateral pawnshops with a 60% LTV ratio against title loans to help you make an informed decision.

Emergency Loan Collateral Pawnshop 60% LTV:

1. What is a pawnshop loan?

A pawnshop loan is a short-term borrowing option where individuals pawn their valuable possessions, such as jewelry, electronics, or musical instruments, in exchange for cash. The pawnbroker holds the item as collateral until the loan is repaid, at which point the borrower can retrieve their item.

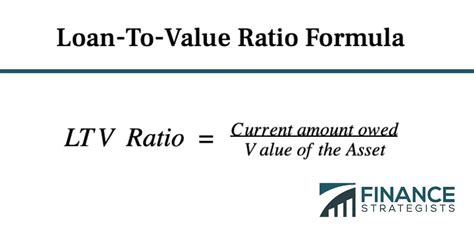

2. 60% LTV ratio:

The 60% LTV ratio for pawnshop loans means that borrowers can obtain a loan equal to 60% of the item’s value. This percentage is lower compared to title loans, providing borrowers with more leverage to repay the loan while retaining a significant portion of their item’s value.

3. Advantages of pawnshop loans:

a. Quick approval and funding: Pawnshop loans are generally easy to obtain, with a streamlined application process and fast approval times.

b. No credit check: Pawnshops do not conduct credit checks, making them an ideal option for individuals with poor credit or those who need funds urgently.

c. Possession of collateral: Borrowers maintain possession of their pawned item throughout the loan term, reducing the risk of losing valuable possessions.

Title Loans:

1. What is a title loan?

A title loan is a secured loan where borrowers use their vehicle’s title as collateral. The borrower retains possession of their vehicle while repaying the loan, but if they fail to do so, the lender can repossess the vehicle.

2. Loan-to-value (LTV) ratio:

Title loans often have higher LTV ratios compared to pawnshop loans. In some cases, lenders may offer up to 50% or even 70% of the vehicle’s value as a loan.

3. Advantages of title loans:

a. Higher loan amounts: Title loans typically offer higher loan amounts compared to pawnshop loans, making them suitable for larger financial needs.

b. Easy process: The process of obtaining a title loan is generally straightforward, with most lenders requiring minimal documentation and quick approval.

c. Possession of vehicle: Borrowers retain possession of their vehicle throughout the loan term, allowing them to continue using their vehicle as needed.

Comparison:

1. Collateral:

Pawnshop loans require borrowers to pawn valuable possessions, while title loans use a vehicle’s title as collateral.

2. LTV ratios:

Pawnshop loans have a 60% LTV ratio, while title loans can range from 50% to 70%. This means borrowers may be able to obtain a larger loan amount with a title loan.

3. Approval process:

Both pawnshop loans and title loans generally have a quick approval process, but pawnshop loans may be more accessible for individuals with poor credit.

Conclusion:

When choosing between an emergency loan collateral pawnshop with a 60% LTV ratio and a title loan, it is essential to consider the type of collateral, LTV ratios, and the overall borrowing process. While pawnshop loans provide more leverage for borrowers to retain their items and have a lower LTV ratio, title loans may offer higher loan amounts and a simpler process. Ultimately, the best option depends on individual needs, circumstances, and the importance of the collateral being used.