In the complex world of debt collection, there’s a surprising tool that consumers can use to their advantage: debt validation letters. These documents can lead to the deletion of 1 in 3 collection accounts, according to various studies. Understanding how to wield this tool effectively can be the difference between settling for a less-than-ideal financial arrangement and having a substantial portion of your debt wiped clean.

**What is a Debt Validation Letter?**

A debt validation letter is a legal document that you can send to a debt collector. It requests specific information about the debt you owe, such as the original creditor, the amount owed, and the date of the last payment. If the collector cannot provide this information within the specified timeframe, they may be required by law to stop pursuing the debt.

**The Legal Framework**

The Fair Debt Collection Practices Act (FDCPA) is the primary law that governs debt collection in the United States. Under the FDCPA, debt collectors must validate a debt if the consumer disputes it in writing within 30 days of the first communication. If the collector fails to provide the required information, they are prohibited from continuing to collect the debt.

**How to Write a Debt Validation Letter**

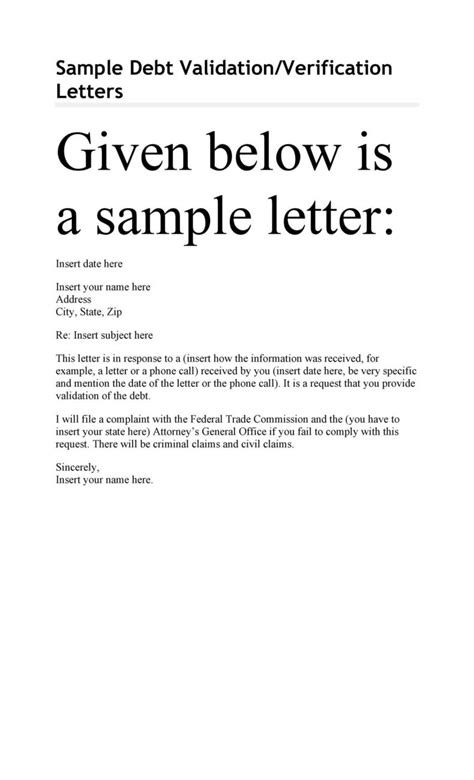

Writing a debt validation letter is a straightforward process. Here’s a basic template:

1. **Header**: Include your name, address, and contact information at the top of the letter.

2. **Date**: Write the date of the letter.

3. **Recipient**: Include the name and address of the debt collector.

4. **Subject Line**: Clearly state that this is a debt validation letter.

5. **Body**:

– Begin by stating that you are responding to the collector’s communication.

– Clearly identify the debt in question, including any account numbers.

– Request validation of the debt, asking for specific information as outlined by the FDCPA.

– Provide a deadline for the collector to respond, typically 30 days.

– Conclude by stating that failure to respond will result in further action, such as disputing the debt with the credit bureaus.

6. **Signature**: Sign the letter and keep a copy for your records.

**The Potential Outcome**

When a debt collector receives a debt validation letter, they are often under pressure to respond promptly. If they cannot provide the requested information within the given timeframe, they may have to cease collection efforts. This can result in the deletion of the debt from your credit report, which can significantly improve your credit score.

**The Importance of Timeliness**

Timing is crucial when using a debt validation letter. It’s essential to send the letter within 30 days of the first communication from the collector. Waiting longer could weaken your case, as the collector may argue that you have waived your rights to validation.

**Conclusion**

Debt validation letters are a powerful tool for consumers facing debt collection. By understanding the legal framework and following the proper procedures, you can potentially have a significant portion of your debt erased. It’s important to act promptly and assertively when using this tool, as it can make a substantial difference in your financial future.